PDI Picks – 3/28/2022

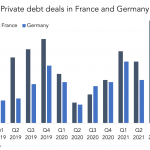

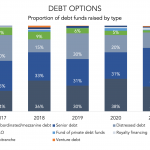

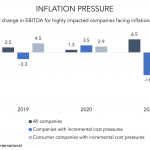

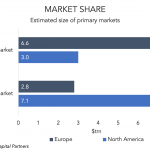

The durability of dealflow in a crisis Private debt deals may take a temporary pause when confronted with volatility, but they soon bounce back. Private debt dealflow typically picks up strongly following market shocks. This was one of the key findings as Deloitte took a look back over ten years of its Alternative Lender Deal…