PDI Picks – 1/29/2024

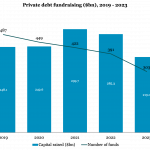

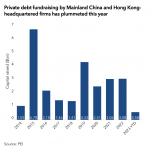

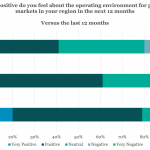

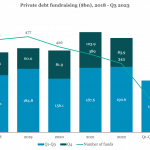

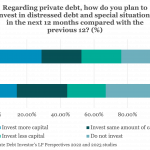

Life after the fundraising slump All private markets, including private credit, experienced a tough 12 months on the fundraising trail in 2023. Hopes are higher for the year ahead. The fundraising figures are in for full-year 2023 and they reveal a drop in global private credit capital accumulation to just $219 billion, the lowest amount…