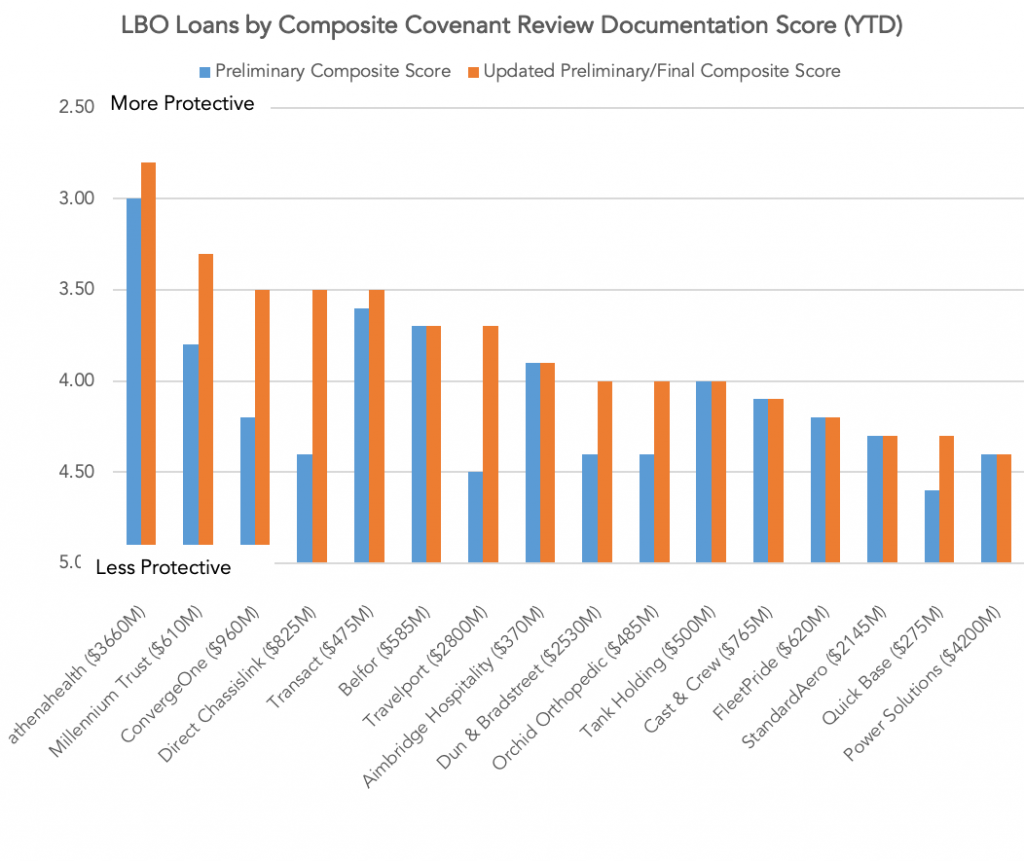

Though covenant-lite has become standard for even leveraged loans that sit at the high end of the middle market spectrum—those between $250 million and $500 million—covenant protections in this segment are generally tighter than those for broadly syndicated deals. The $260 million loan that backs Reverence Capital Partners’s LBO of Transact is a timely example. After making a series of covenant tweaks last week, the Transact’s Documentation Score—which ranks loans from 1 (most protective) to 5 — moved to 3- from 4+ at launch. That puts the deal at the most protective end of the recent range of LBOs.

What is Documentation Score?

Covenant Review’s Documentation Scores express the strength of an instrument’s covenant protections on a number scale running from 1 (strongest) to 5 (weakest) with pluses and minus to between 1 and 5 to provide more context to the scores. Documentation Scores are derived from Covenant Review’s market-leading analysis of loan documents by our staff of experienced leveraged finance attorneys. For each loan, Covenant Review will provide one overarching Composite Score that is based on the following three sub-scores: (1) Collateral Protection, (2) Default Protection and (3) Lender’s Repricing Optionality. Covenant Review applies a proprietary weighing method to a series of qualitative, empirical, and judgment factors to produce each composite score and sub score.

Contact: Steven Miller