The serial issuer phenomenon: mastering the art of repricing

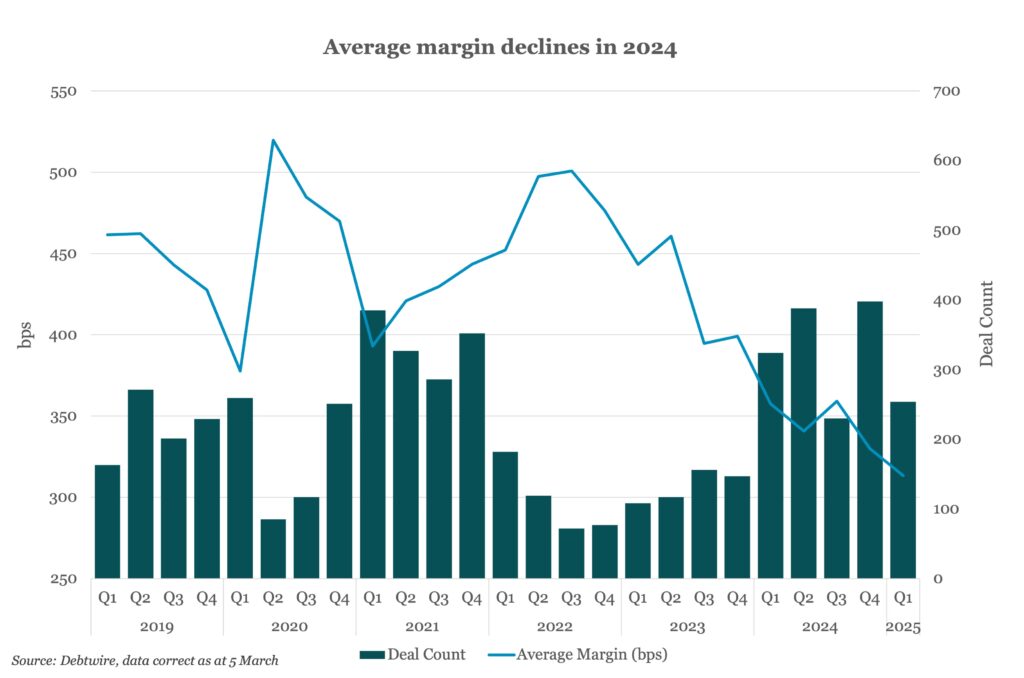

An increasingly tight leveraged finance environment prompted borrowers to visit the loans market multiple times in 2024 in order to reduce pricing on their existing debt. Three rate cuts by the US Federal Reserve and increasingly tight spreads from demand outpacing supply were the main factors that led companies to increase the frequency of their deals compared with previous years.