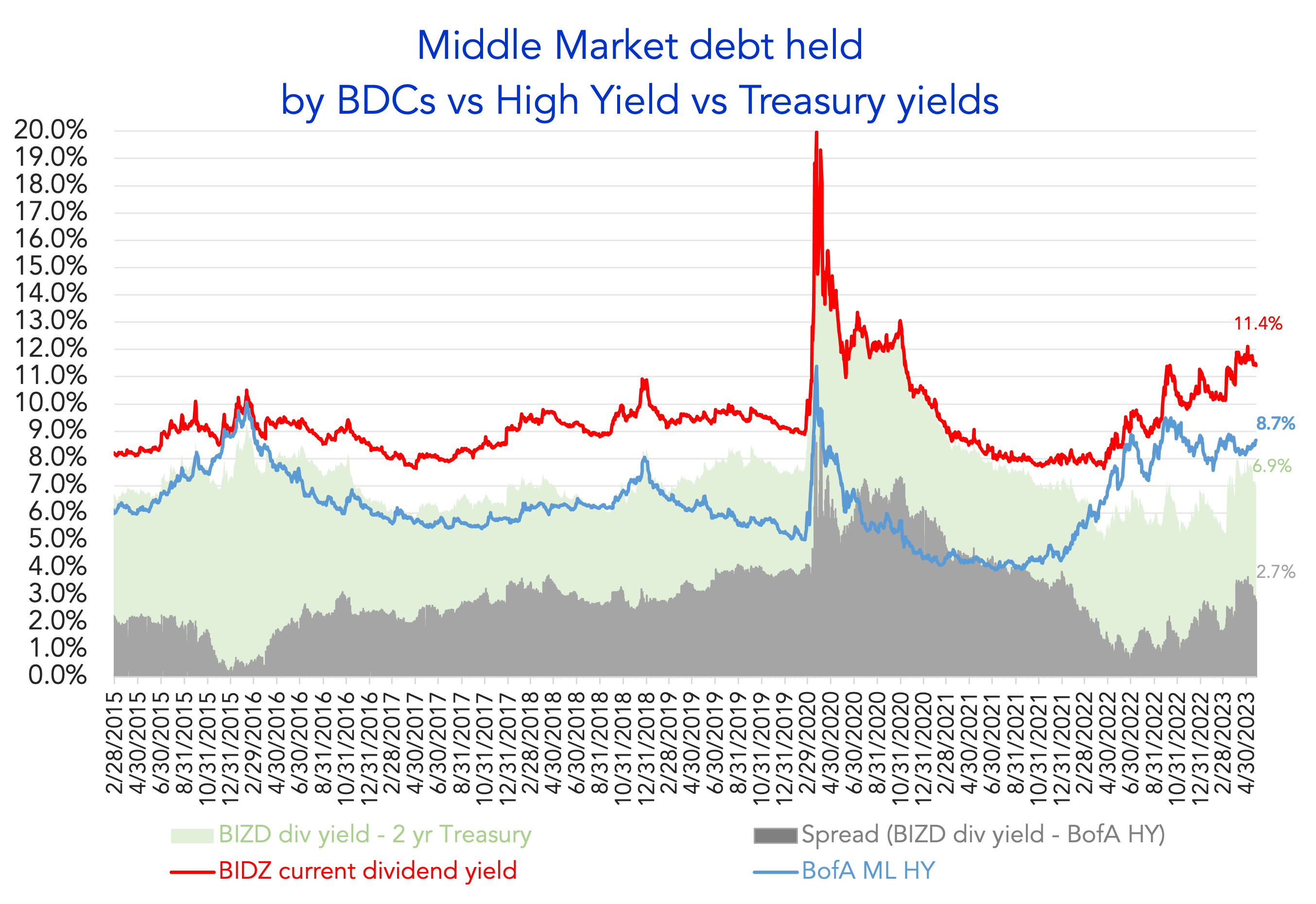

Source: VanEck BDC Income ETF and BofA Merrill Lynch US High Yield Effective Yield

The red line in the chart is the current dividend yield of the *VanEck BDC Income ETF (BIZD) that tracks the overall performance of publicly traded business development companies (BDCs, lenders to privately held middle-market businesses that tend to be below investment grade or not rated, with most lending comprising of senior secured loans). The blue line displays the BofA Merrill Lynch US High Yield (US HY index – currently at 8.67% as of 26 May), which tracks the performance of USD denominated below investment grade corporate debt publicly issued in the US. Increase in high yield depicts dislocations in the market, pricing in higher risk.