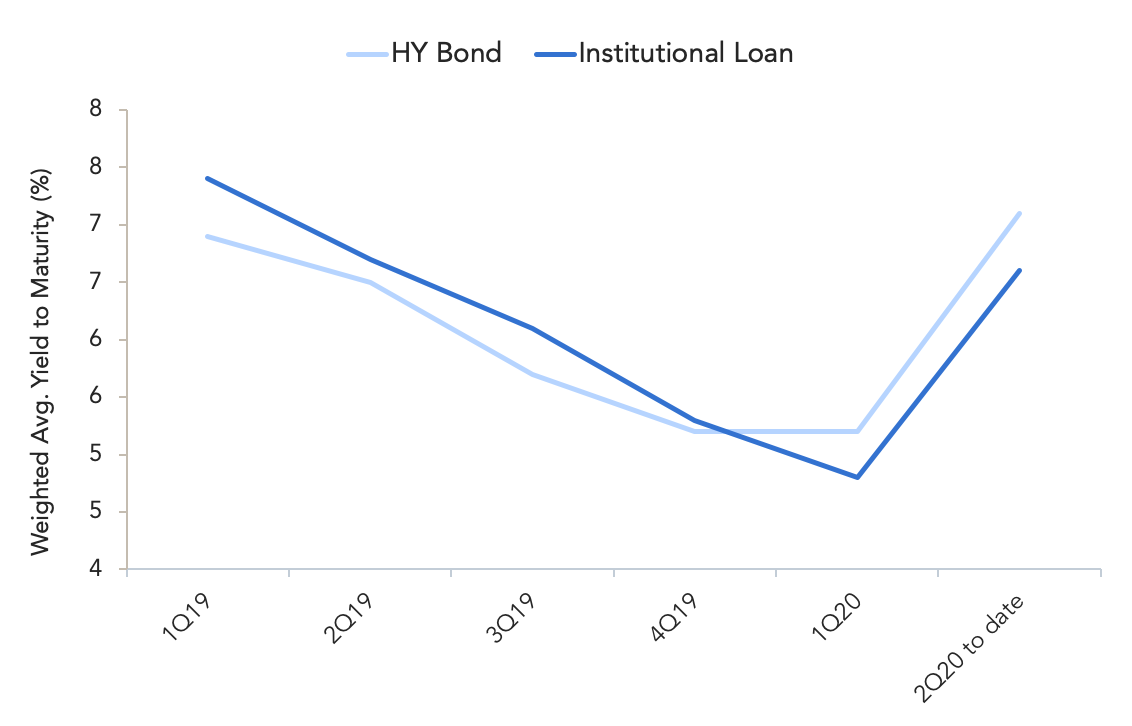

Cost of borrowing rises

across the leveraged debt markets in 2Q20

Source: Debtwire Par

The cost of borrowing comes at a higher price in 2Q20 as risk is repriced in the leverage debt markets. Following several quarters of tightening spreads, the weighted average yield to maturity (YTM) of bonds issued so far in 2Q20 has increased to 7.1% from 5.2% in 1Q20. Pricing has begun to show signs of improvement, however, with deal flow in early June pricing at 6.1% on average, down from 7.5% in April and 7.2% in May.