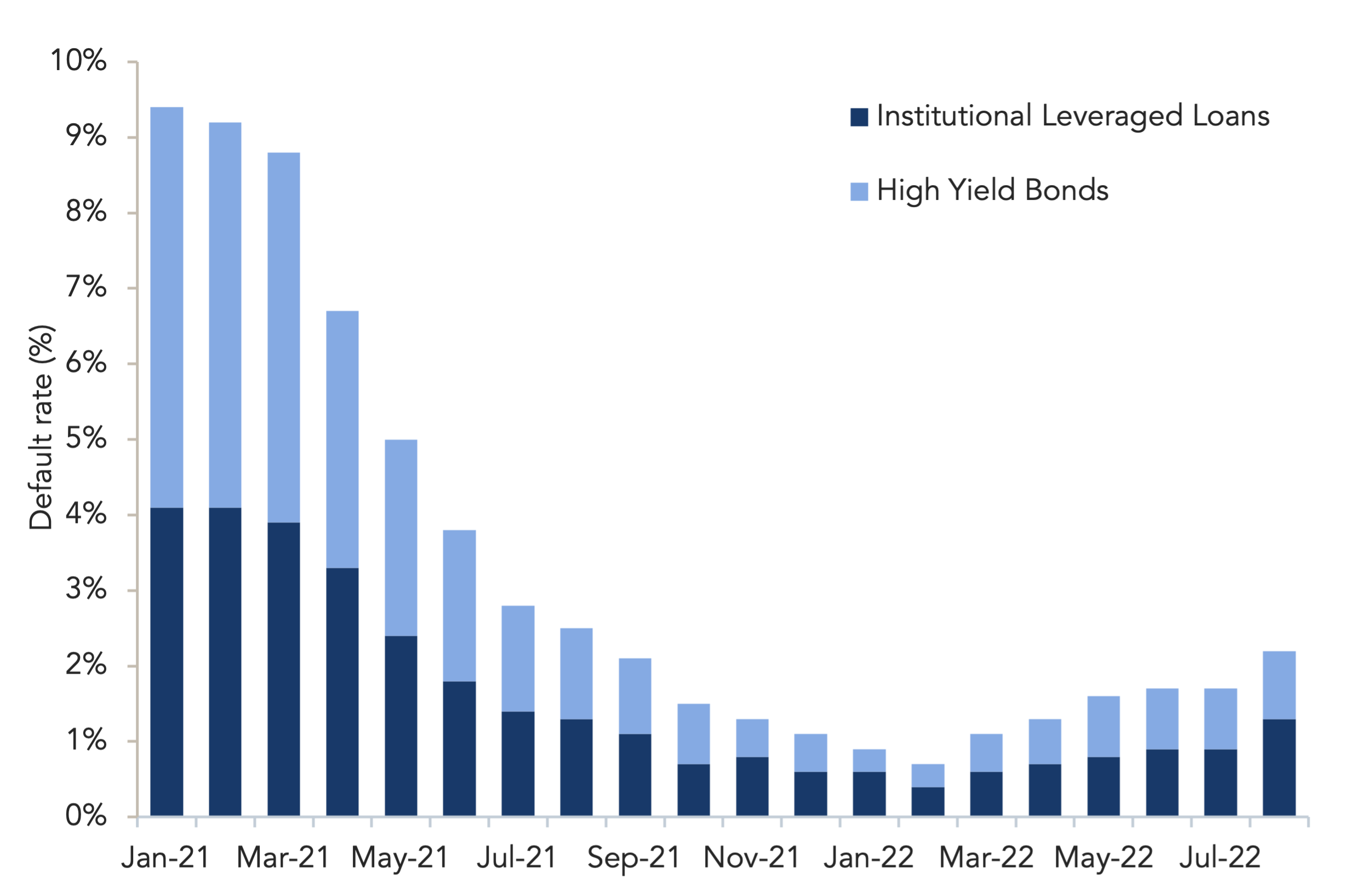

Leveraged loan & high yield bond

default rate creeps up from recent lows

Source: Fitch Ratings, Debtwire Par

One area to watch as the Federal Reserve maneuvers a soft landing from inflation will be the credit health of leveraged borrowers in the face of prolonged economic pain caused by tightening monetary policy. August saw an uptick in loan defaults, with a total of USD 6bn in default volume across six borrowers – the highest monthly total since October 2020. Endo International’s USD 1.975bn Chapter 11 filing was the largest of the month, followed by Lumileds’ USD 1.67bn filing. This pushed the trailing twelve-month average default rate up to 1.3% in August from 0.9% in July. Notably, year-to-date default volume through August, at USD 17.6bn is more than triple the total this time last year.