Structure of Revlon’s BrandCo Loan May Advantage BrandCo 2L Recoveries

on RemainCo Collateral at the Expense of 2016 Term Lenders

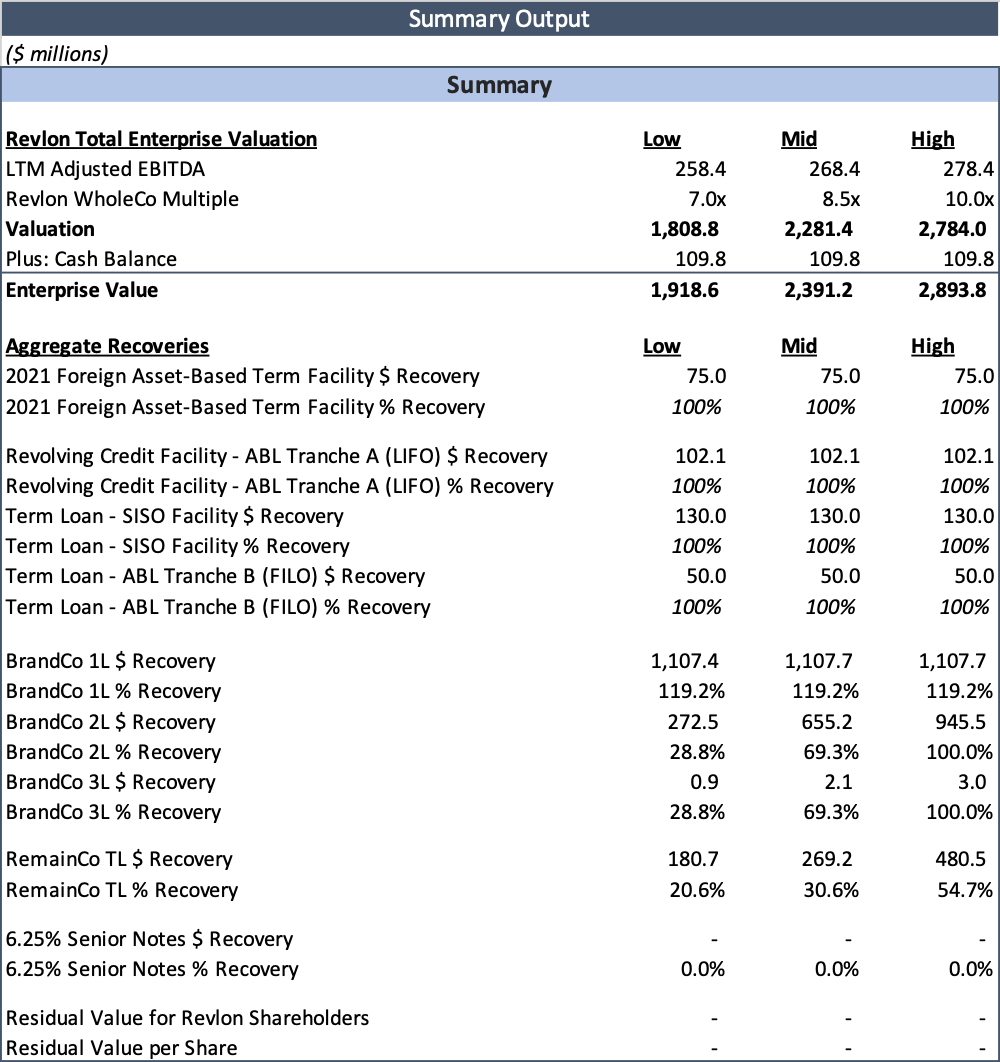

Numerous refinancing transactions in recent years, including Revlon’s success in addressing its 2021 unsecured note maturity last year with an out-of-court solution, leaves the company with an incredibly complex capital structure consisting of foreign term loans, a three-tiered ABL facility, a three-tiered “BrandCo” facility, a partially paid-down regular-way term loan and one unsecured note issuance. Click through for our Americas Core Credit experts analysis of the Revlon refinancing situation.

Contact: Matt Danese

mdanese@reorg.com