Featuring Charts

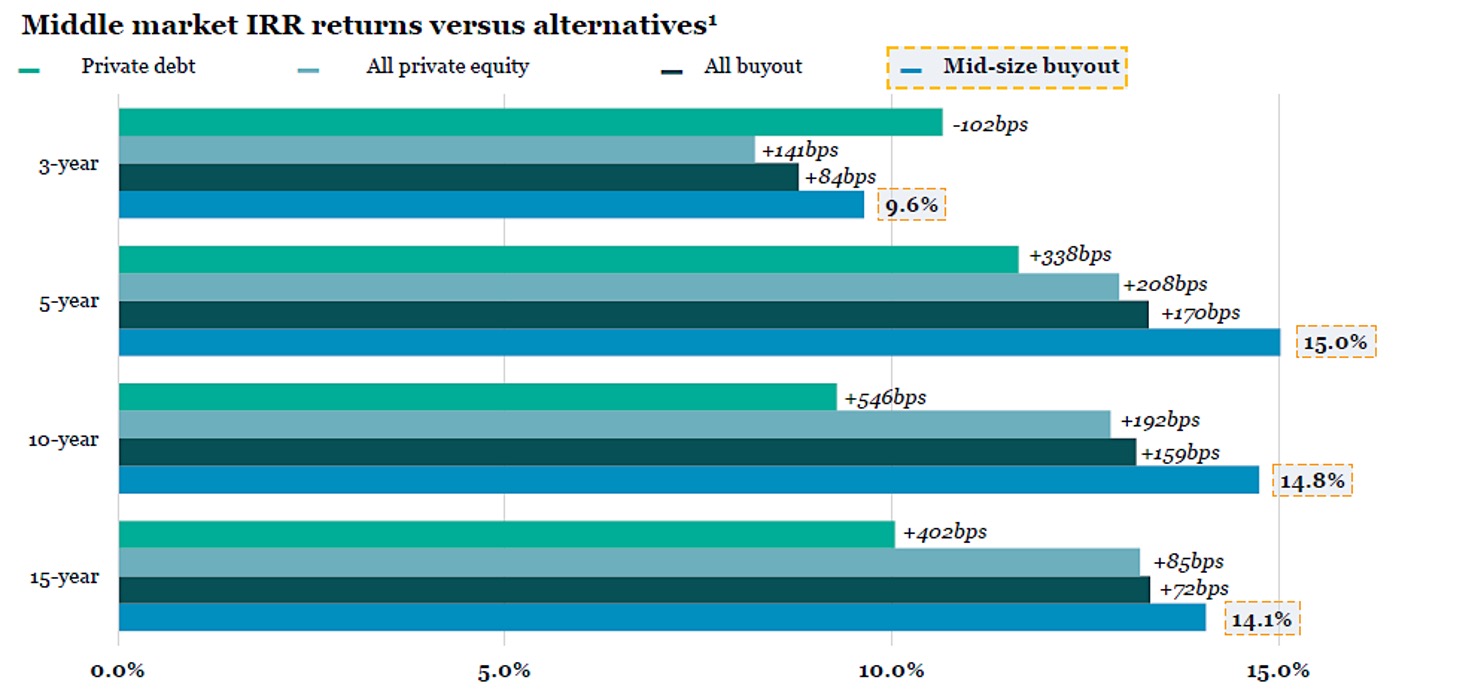

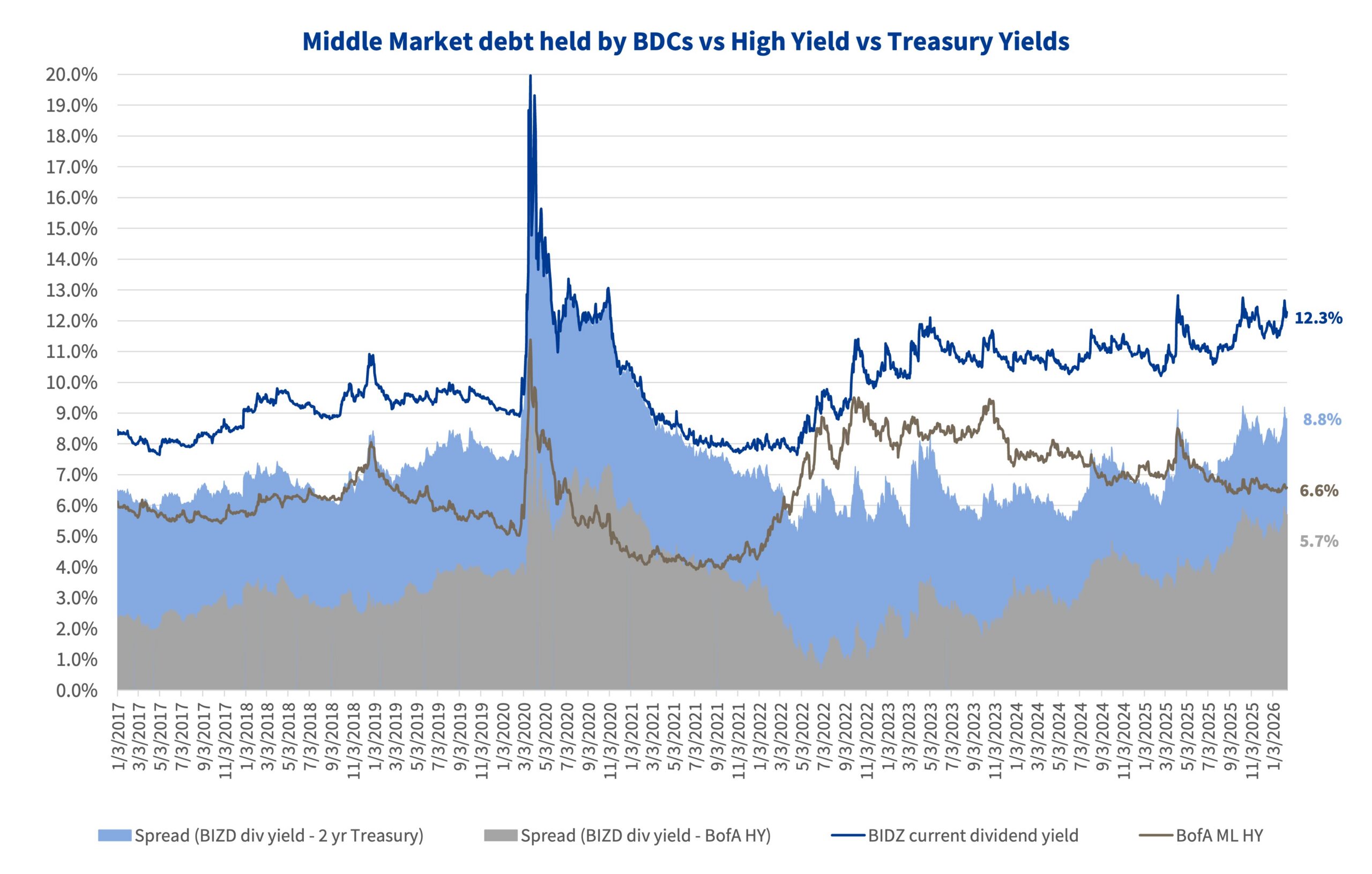

Chart of the Week: The Sweet Spot

The middle market punches above its weight. Source: State Street Private Equity Index as of 9/30/2025

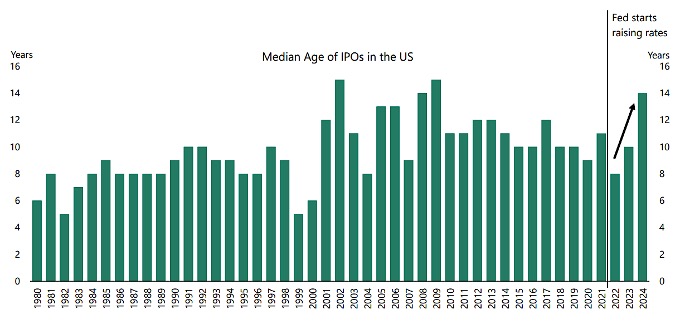

Read MoreChart of the Week: Private-Side Only

US companies that go public are opting to stay private longer. Source: Jay Ritter, University of Florida; Apollo’s The Daily Spark

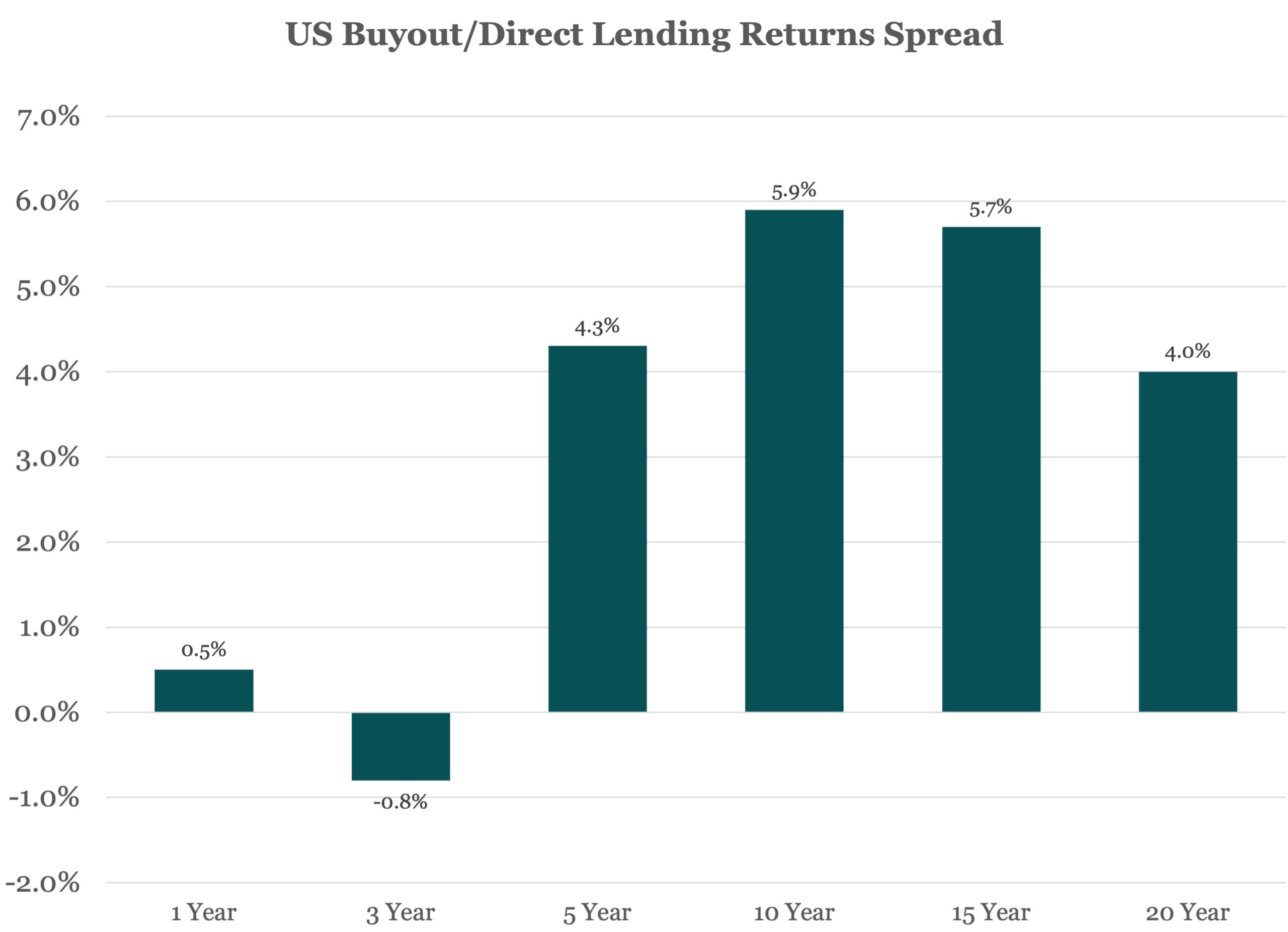

Read MoreChart of the Week: The Equity Premium

In the long-term private equity pays for more risk with better returns. Source: MSCI

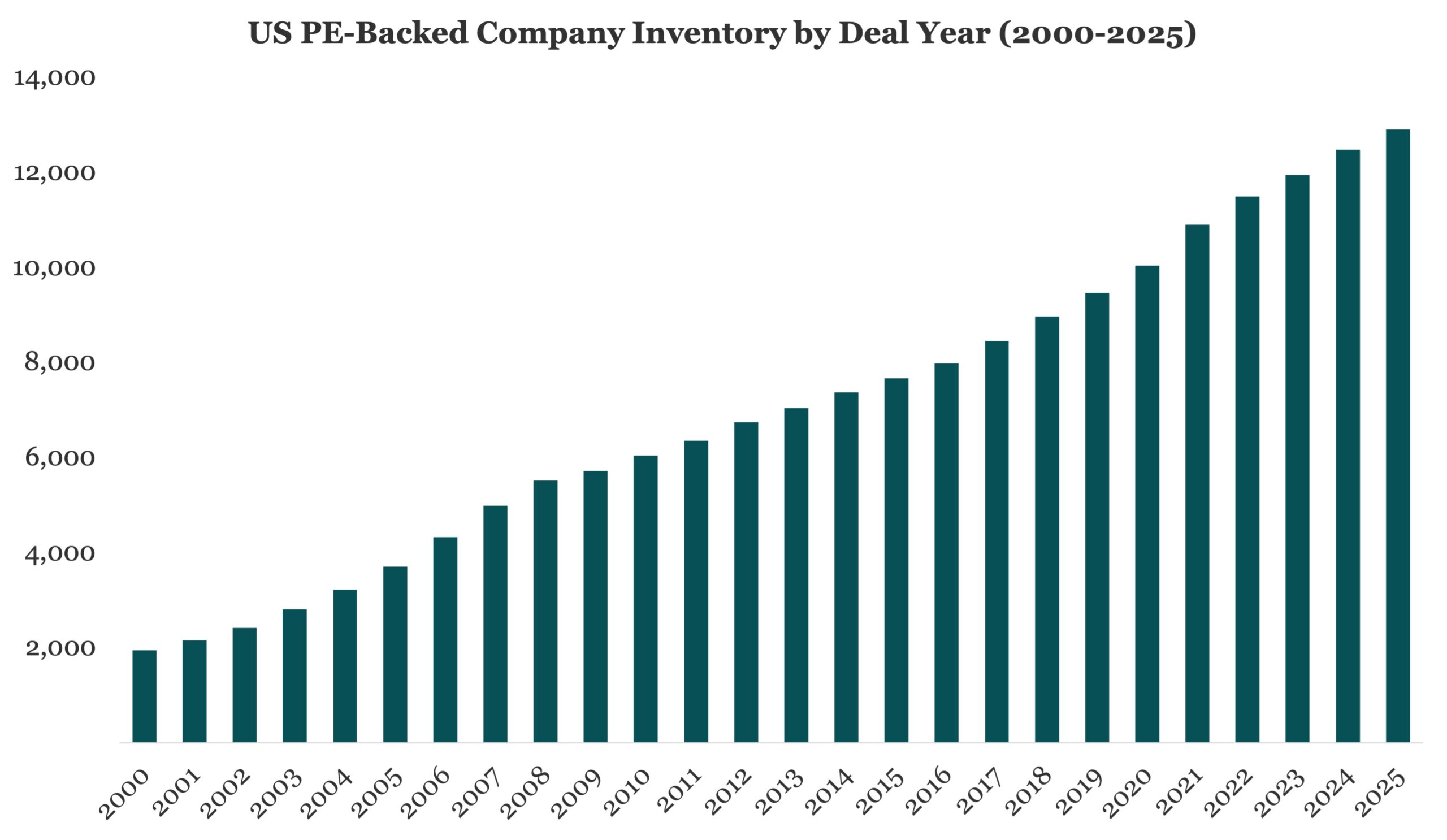

Read MoreChart of the Week: Inventory Check

Private equity remains an attractive option for investors through cycles. Source: PitchBook

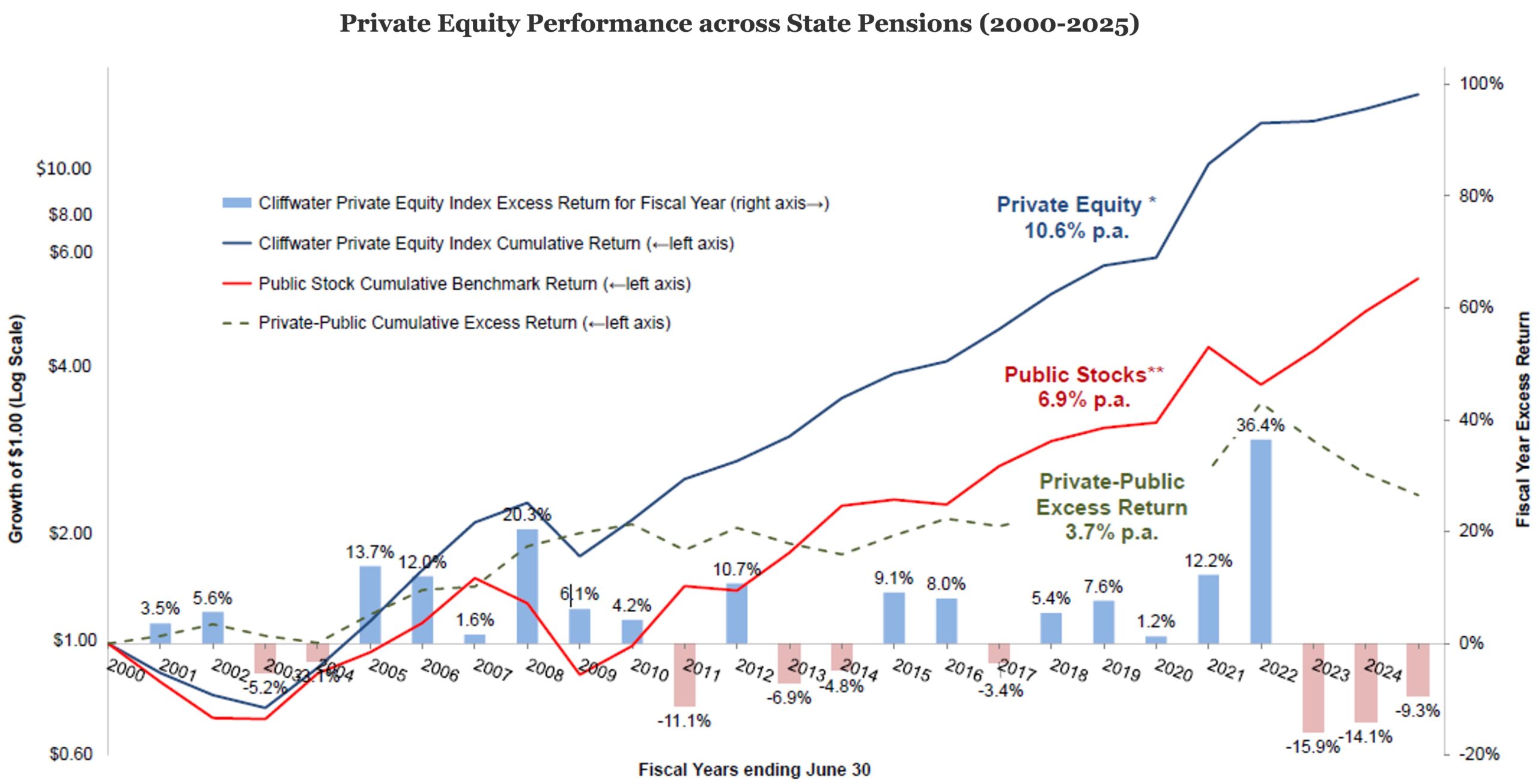

Read MoreChart of the Week: State of Returns

For over two decades private equity has outperformed public stocks in state pension plans. Source: Cliffwater

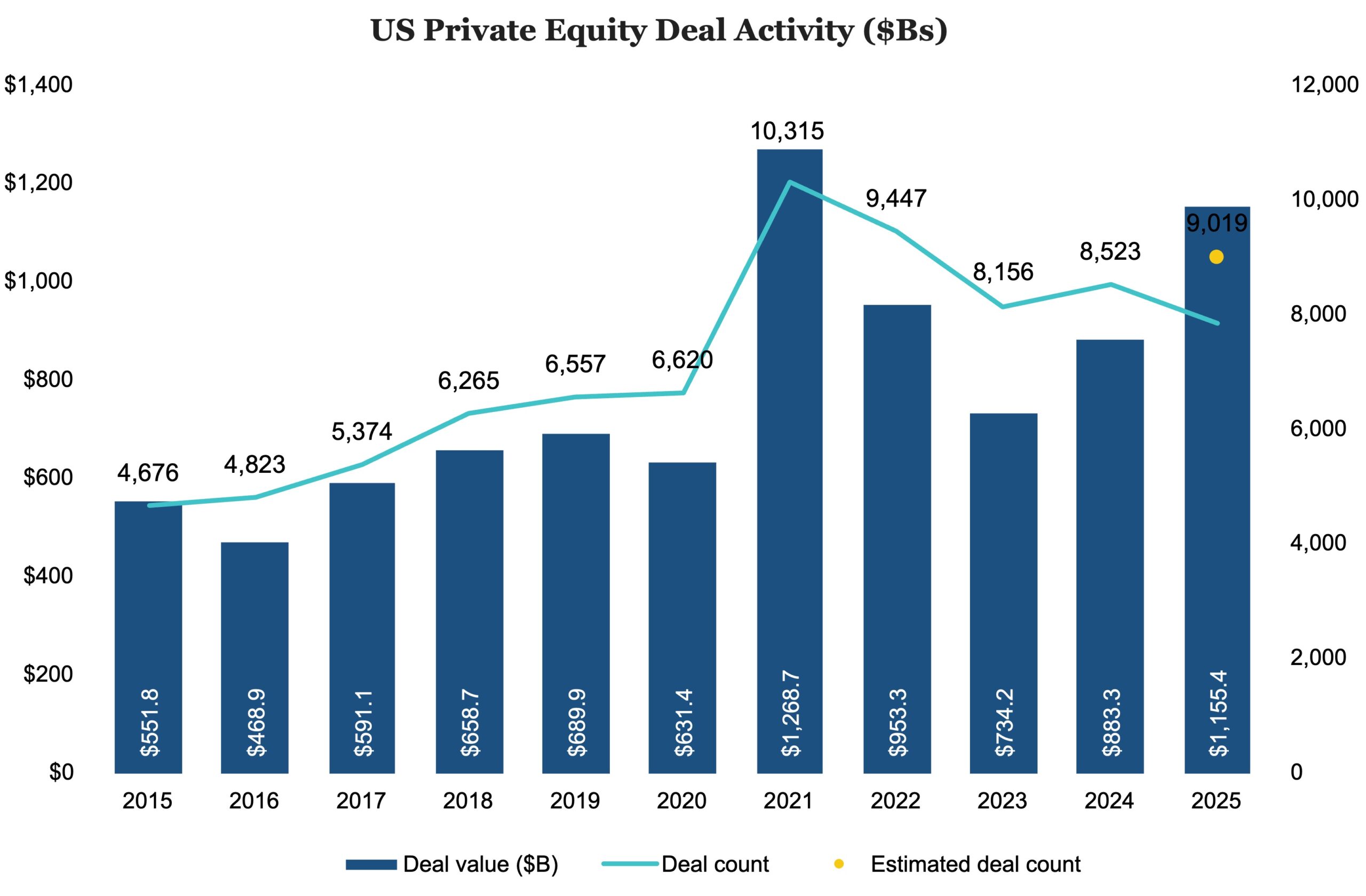

Read MoreChart of the Week: Back in the Game

While PE deals transacted shrunk since 2021, deal values rose over past three years. Source: PitchBook

Read MoreSubscribe Now!

Join the leading voice of the middle market. Try us free for 30 days.

Click here to view the Newsletter sample.

What is the Lead Left?

- One-stop source for deals and data

- Market trend commentary and analysis

- Exclusive interviews with thought leaders

View Article By

Features

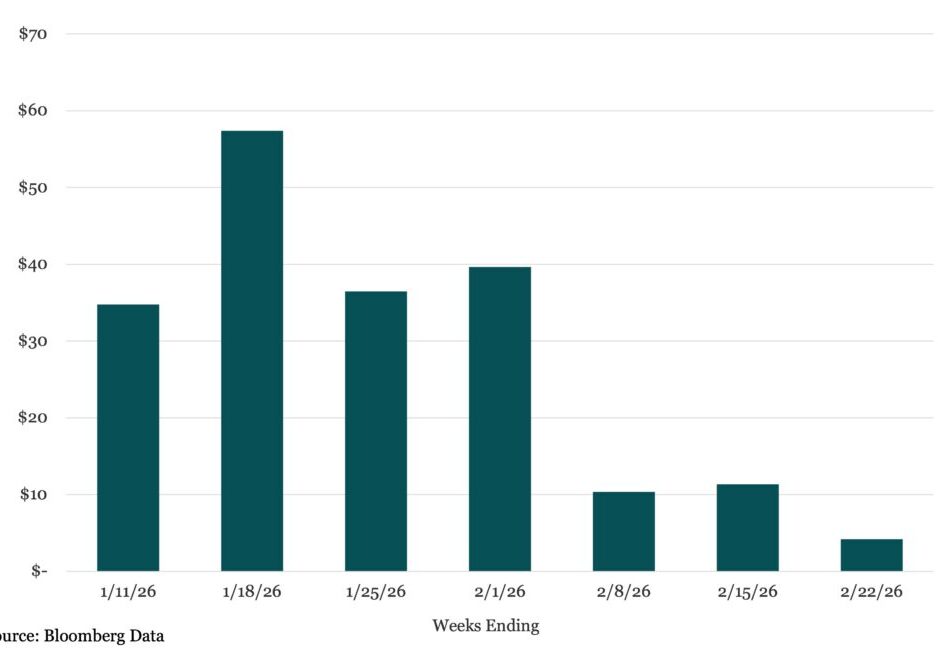

Bloomberg: Leveraged Lending Insights – 2/16/2026

Primary Market Activity Cools Following Active January Click here to access Bloomberg’s US Leveraged Finance Chartbook After a robust start to the year that saw $168.2b in US leveraged loan launches during January, primary market activity has slowed considerably. Through Wednesday, February 18, just $25.9b of new deals have launched – marking the lowest level…

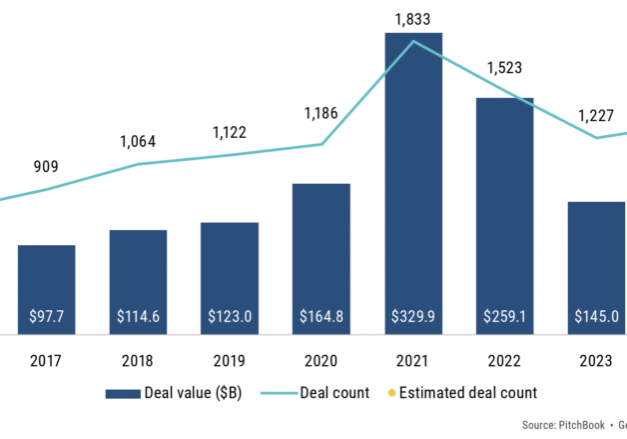

The Pulse of Private Equity – 2/16/2026

Technology PE deal activity Download PitchBook’s Report here. Technology PE deal activity experienced an outsized year, with deal value higher by 67.4% YoY even though deal count rose by a relatively more modest 13.4%…. Subscribe to Read MoreAlready a member? Log in here...

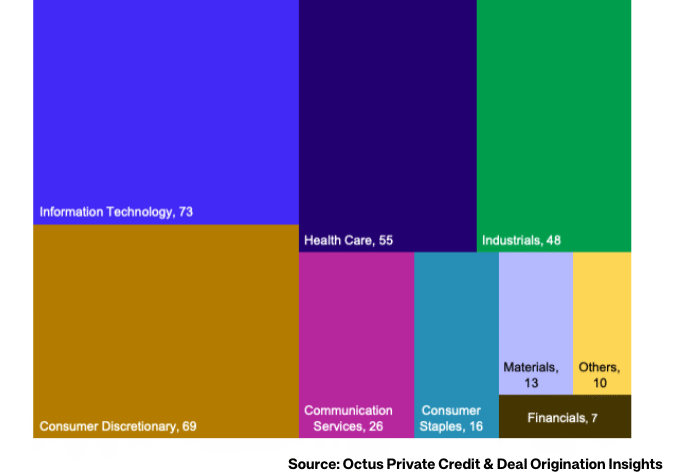

Octus: Private Credit & Deal Origination Insights – 2/16/2026

Issuers in the Information Technology (23%) and Consumer Discretionary (22%) Sectors Topped BDC Non-Accruals as of Q3’25 Click here to request access to the full report. Business development companies, like much of the market, have been focusing on their exposure to software…. Subscribe to Read MoreAlready a member? Log in here...

Middle Market & Private Credit – 2/16/2026

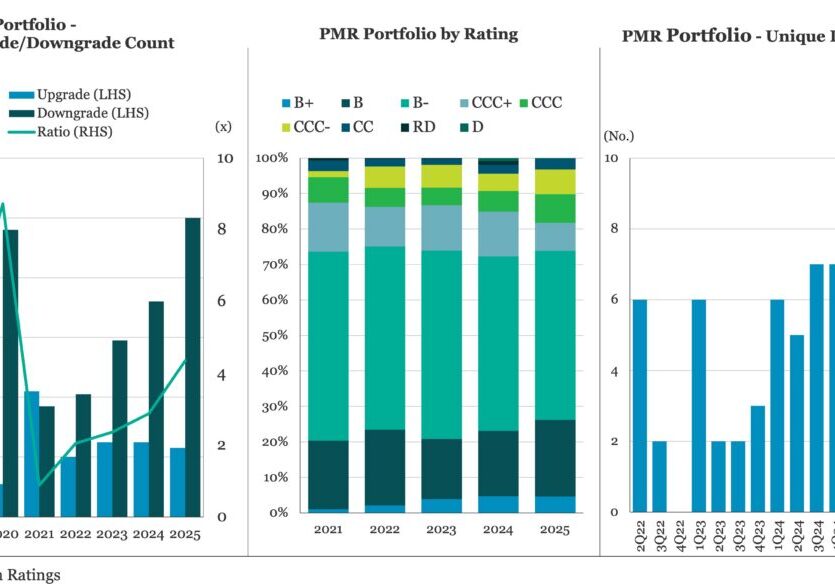

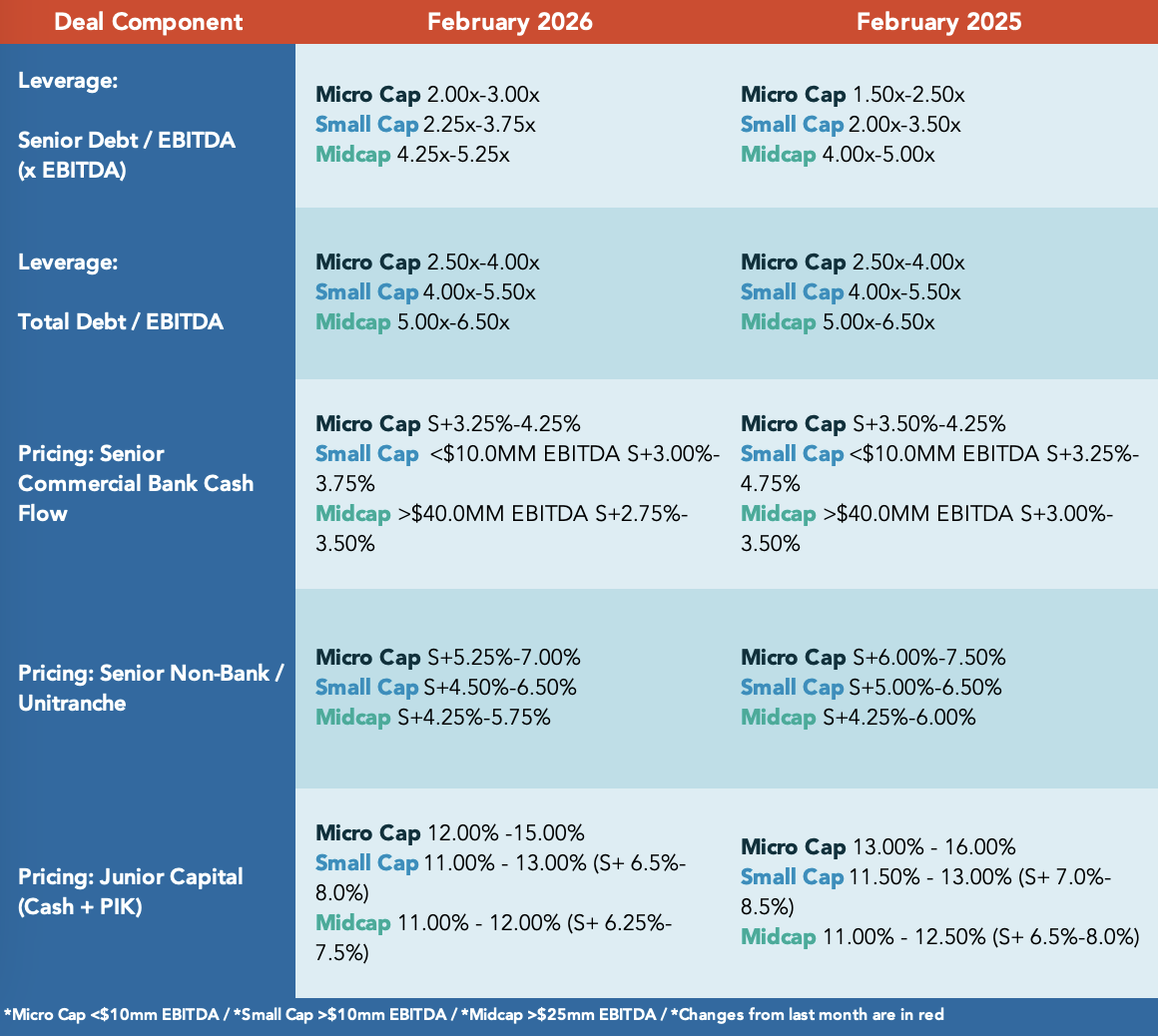

U.S. Private Credit and Middle Market Performance Monitor: 4Q25 Click here to learn more. Fitch’s Privately Monitored Ratings (PMR) Portfolio – 4Q25 In the charts above, Fitch presents aggregate data for issuers in its PMR portfolio. Fitch privately rates these issuers on behalf of asset managers…. Subscribe to Read MoreAlready a member? Log in here...

Leveraged Loan Insight & Analysis – 2/16/2026

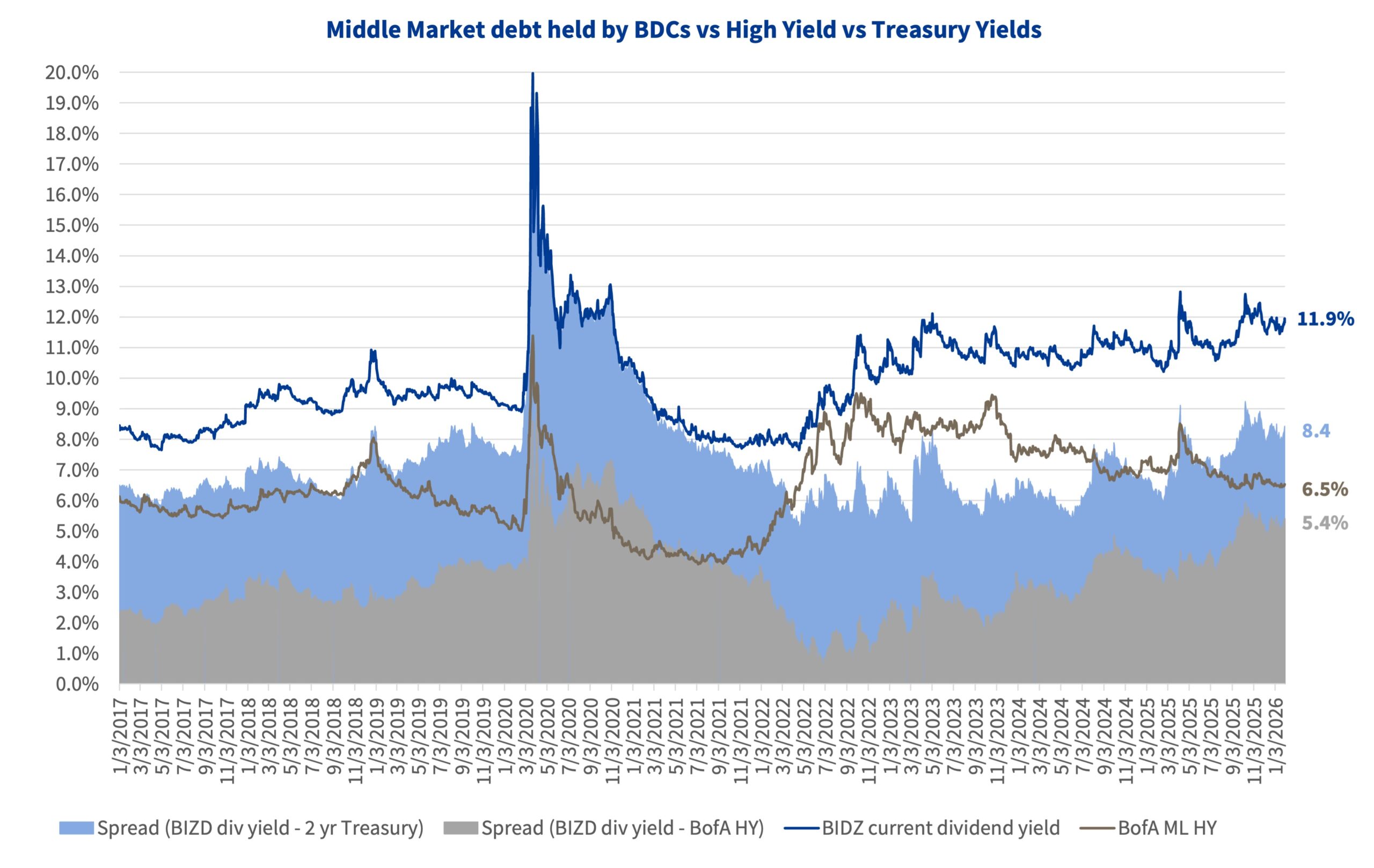

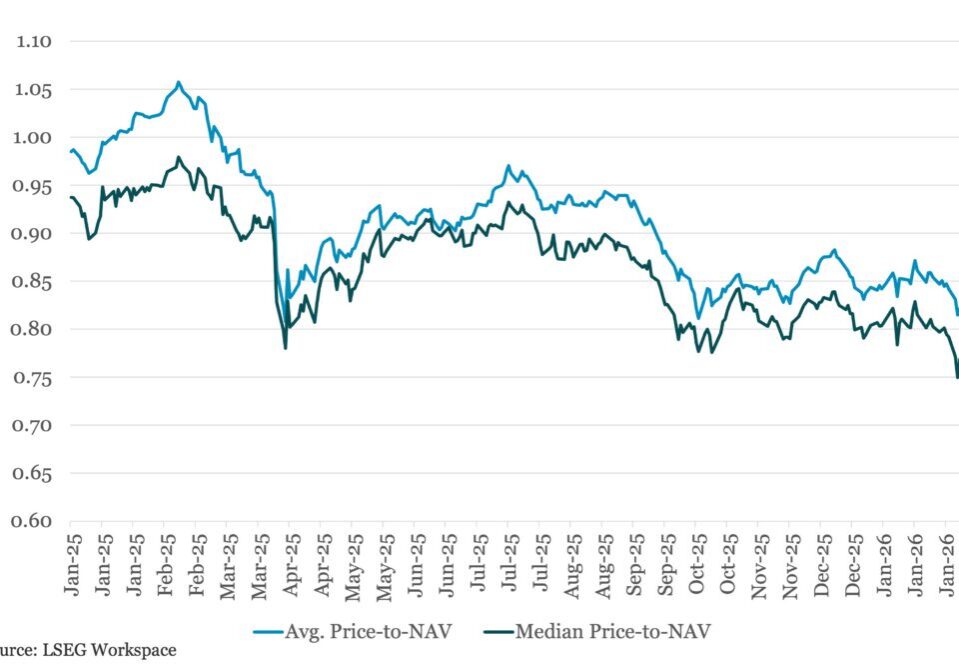

BDC share price to NAV moves lower amid expected lower base rates and software sector exposure BDC valuations have moved lower recently amid some concerns around credit quality, specifically in the software sector, in which many BDCs have sizeable stakes…. Subscribe to Read MoreAlready a member? Log in here...

Beginning in July 2022 The Lead Left published a series of articles on credit market. This report consolidates those articles.

Cov-lite trends Inflation & rising interest rates – LIBOR to SOFR transition Mega-tranche uni trend ESG takes center stage Login to view interactive report and download PDF version. … Subscribe to Read MoreAlready a member? Log in here Related posts: 2H 2021 Midyear Outlook Report State of the Capital Markets – Fourth Quarter 2016 Review and

Beginning in September 2021 The Lead Left published a series of articles on supply chain. This report consolidates those articles.