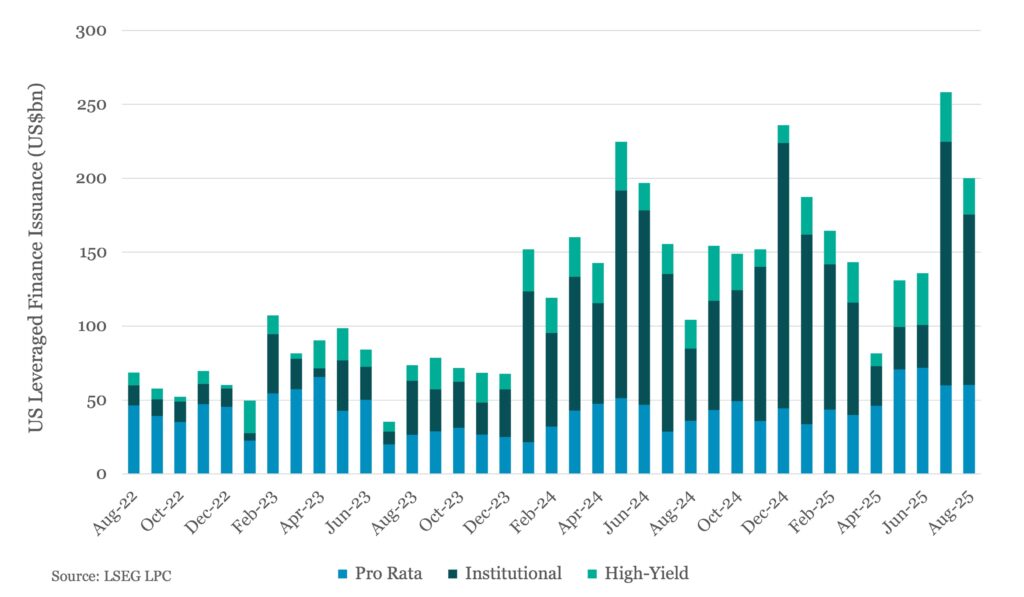

US LevFin issuance slips to US$200bn despite historically active August

For US LevFin, we saw trends of previous months continue to play out in August: (1) Defense over offense, with issuers largely focused on managing liabilities versus making acquisitions; (2) Strategic M&A driving the majority of underwritings; (3) Rate-sensitive LBO trades struggling to catch bids on valuations; (4) High-yield bond issuance holding somewhat steady despite minimal (if any) contribution from AcqFin.