Bloomberg: Leveraged Lending Insights – 7/7/2025

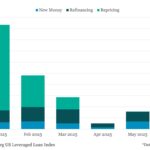

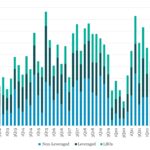

US Leveraged Loan Issuance Tops $65bn in June June’s 75 deals for $66b was up $34.4b, or 109%, from the previous month’s $31.6b, but was down $83.6b or 56% from the same month a year ago. It brought the Q2 total to $107.4b across 128 deals for a 68% decline from the first quarter total…