Bloomberg: Leveraged Lending Insights – 6/23/2025

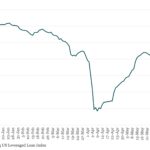

Leveraged loan prices continue to climb in secondary market Average secondary market prices on US Leveraged loans reached 96.44 on June 25th, the highest level since March 17th according to the Bloomberg US Leveraged Loan Index. So far in June, the index has returned 0.51%, bringing the year-to-date figure to 2.47%…. Subscribe to Read MoreAlready