TheLeadLeft

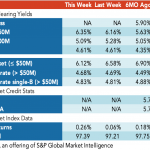

Loan Stats at a Glance – 1/17/2022

Contact: Marina Lukatskymarina.lukatsky@spglobal.com

PDI Picks – 1/17/2022

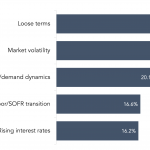

LP appetite strong, but some concerns are voiced Inflation and high valuations are among the factors making investors a little more uncomfortable than normal about private credit’s prospects. The release of our annual LP Perspectives study is a chance to probe LPs on their allocation strategies for the private debt market over the next 12…

Private Debt Intelligence – 1/17/2022

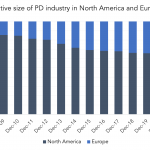

Regulatory changes in Europe could stimulate PD industry The European Union has taken steps to gain the benefits offered by the Chapter 11- bankruptcies regime, shifting the focus from companies’ liquidation to protecting creditors’ rights and keeping the business afloat. The North American private debt market has always dwarfed the European market… Subscribe to Read

2022 Outlook: ESG Focus

As we wrap up our special series on the 2022 private credit outlook, we turn our attention to #ESG. As our Chart of the Week highlights ESG is a fundamental concern of investors. How impactful it will be on manager behavior will depend on regulation and client demand. ESG in some form has been around […]

Leveraged Loan Insight & Analysis – 1/10/2022

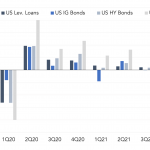

US leveraged loan returns advance to 5.2% in 2021, HY bonds gain 5.4% US leveraged loans wrapped up 2021 by posting a return of 0.78% in the fourth quarter, outpacing both high yield bonds (0.66%) and investment grade bonds (0.17%). In comparison, returns on the S&P500 accelerated to 10.7% in 4Q21, the highest all year….

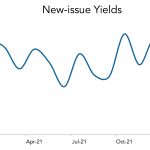

LevFin Insights: High-Yield Bond Statistics – 1/10/2022

Source: LevFin Insights Source: LevFin Insights Source: Lipper (Past performance is no guarantee of future results.) Contact: Robert Polenberg robert.polenberg@levfininsights.com

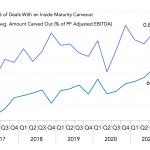

Covenant Trends – 1/10/2022

Accordion Inside Maturity (Past performance is no guarantee of future results.) Contact: Steven Miller

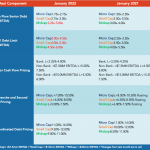

Middle Market Deal Terms at a Glance – January 2022

Source: SPP Capital Partners Contact: Stefan Shaffer stefan@sppcapital.com

Lead Left Presents: M&A Outlook for 2022 (First of a Series)

We will be starting the new year with a bang, kicking off next week our first “Lead Left Presents” webinar. This debut session will feature top middle market investment bankers discussing what happened in the deal market in 2021 and what’s to come for 2022. So much attention has been paid to record financings and…