Reorg Credit Intelligence – 8/9/2021

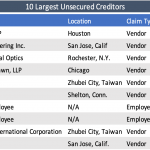

SVXR Seeks to Sell Assets With Bruker Nano as $11.9M Stalking Horse; Noteholders Do Not Consent to Proposed $2M DIP Financing SVXR, a San Jose, Calif.-based developer and manufacturer of high-resolution, automated x-ray inspection and metrology equipment for the semiconductor and advanced-electronics markets, filed for chapter 11 protection on Wednesday, Aug. 4, in the Bankruptcy…