TheLeadLeft

PDI Picks – 6/28/2021

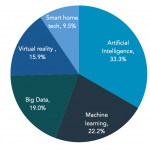

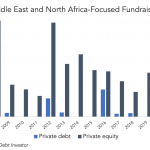

Private debt warms up in the Middle East Sovereign wealth interest is becoming apparent as one of the world’s nascent debt markets shows signs of growth. As a relatively new asset class, private debt remains heavily undeveloped outside of North America and Europe. For investors looking to diversify outside of these regions and gain emerging…

Covenant Trends – 6/28/2021

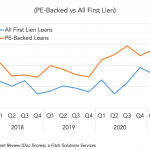

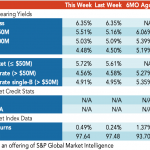

% of Loans that Cleared with an MFN Sunset (Past performance is no guarantee of future results.) Contact: Steven Miller

Reorg Credit Intelligence – 6/28/2021

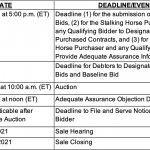

CP Holdings Seeks to Run Sale Process With Stalking Horse/DIP Lender Tor Asia Credit Master Fund, Prepetition Lender Under Debtor-Guaranteed Loan Dallas-based CP Holdings LLC and Pacrim U.S. LLC, which wholly own 47 nondebtor subsidiaries that operate 10 rural assisted living and memory care facilities in Alabama and Texas, filed for chapter 11 protection on…

Loan Stats at a Glance – 6/28/2021

Contact: Marina Lukatskymarina.lukatsky@spglobal.com

European Direct Lending – A New Series

Say what you will about last year’s Covid-induced downturn in the US beginning in March. But it paled in comparison to the UK’s economic cratering. Not since the Great Frost of 1709 had that proud nation suffered such a dramatic slump. But then, like the US, the UK and Europe began to recover in similar […]

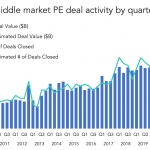

The Pulse of Private Equity – 6/21/2021

A solid start in the middle market Download PitchBook’s Report here. PitchBook’s latest US Middle Market Report shows a strong start to 2021, with the second highest quarterly totals in terms of value. An estimated $119.5 billion was invested in middle market companies in Q1. Combined with the record $160 billion from Q4, almost $280 billion…

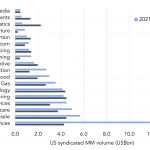

Leveraged Loan Insight & Analysis – 6/21/2021

Business services is top sector for US syndicated mid-market loan volume so far this year Through deals of June 18, year-to-date syndicated middle market volume totals US$60.2bn, 30% higher than the US$46.3bn recorded during the same period last year. The top industry so far this year is the business services sector, which has notched US$13.4bn…

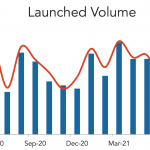

LevFin Insights: High-Yield Bond Statistics – 6/21/2021

Source: LevFin Insights Source: LevFin Insights Source: Lipper (Past performance is no guarantee of future results.) Contact: Robert Polenberg robert.polenberg@levfininsights.com