TheLeadLeft

The New M&A (First of a Series)

This week we kick off a new series on COVID-impacted deal flow, with a look “upriver.” How has M&A activity been affected, and what should deal makers expect for the “new normal?” We spoke to select middle market investment banks about their experiences so far in this coronavirus season. The beginning of the crisis caught…

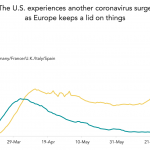

Chart of the Week: Case Study

Opening of state economies has new COVID cases in the US outpacing Europe.

PDI Picks – 7/20/2020

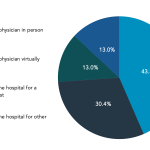

The long and winding road Fund managers have found it difficult persuading investors to part with commitments during the pandemic, but demand is still strong. It’s not only economies upon which the covid-19 pandemic is having a slowing effect. As our chart above shows, it’s also the speed with which investors are making commitments to…

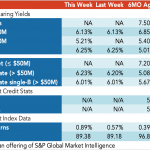

Loan Stats at a Glance – 7/20/2020

Contact: Marina Lukatskymarina.lukatsky@spglobal.com

The New Healthcare: COVID and the Government

Two years ago, we issued a special report on healthcare trends. We recently revisited one of our sources, a top healthcare investor. “Everyone’s an infectious disease expert now,” he told us in an interview. “We need to change the way we look at infection. There are about 40,000 deaths annually from the seasonal flu. It […]

Leveraged Loan Insight & Analysis – 7/13/2020

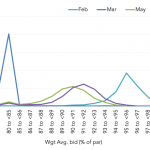

Weighted average bids of US CLO portfolios continue to edge higher The value of loan assets in U.S. CLO portfolios has continued to trend higher over the last three months, clawing back some of the losses that battered markets at the end of March, according to analysis from LPC Collateral. Looking at the distribution of…

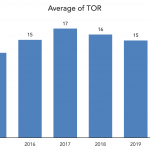

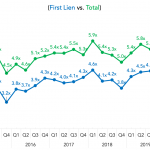

Covenant Trends – 7/13/2020

Average Adjusted Leverage for M&A-Driven Loan Deals Contact: Steven Miller

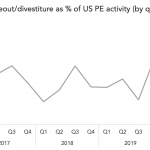

The Pulse of Private Equity – 7/13/2020

Carveouts inching up Download PitchBook’s Report here. Carveouts are up slightly as a proportion of US PE activity, according to PitchBook’s latest Breakdown Report. They made up 10% of all deal flow in Q2, which is on the high end of what we’ve seen over the last three years. Carveouts didn’t boom in numbers in Q2…