Leveraged Loan Insight & Analysis – 7/22/2024

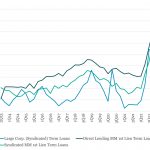

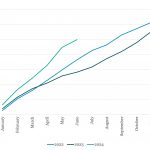

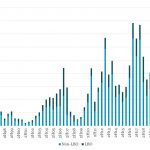

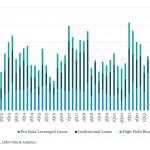

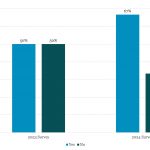

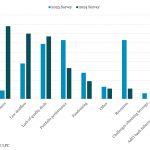

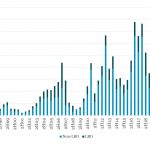

Premium for MM direct lending loan yields over large corporate credits averaged 265bp in 2Q24 Pricing tightened across all market segments in 2Q23 as demand for assets outpaced supply. This enabled borrowers to obtain more attractive pricing on new credits and refinance existing debt…. Login to Read More...