TheLeadLeft

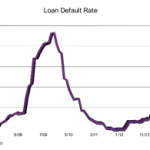

CHART OF THE WEEK

Oh, That Default The long-awaited default of Energy Future Holding’s$19.5 billion in loans, while pushing April’s figure by volume to 4.6% – a four-year high – is not expected to signal any change in analysts’ positive loan performance outlook. … Login to Read More...

MARKIT RECAP

It’s been a while since the eurozone’s periphery had any meaningful impact on broader market sentiment. Mario Draghi’s “whatever it takes” pronouncement in 2012 put paid to the regular bouts of volatility emanating from Europe’s beleaguered sovereigns…. Login to Read More...

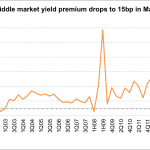

Leveraged Loan Insight & Analysis

The middle market yield premium on first-lien institutional term loans has dropped to just 66bp this quarter; its lowest level since 3Q09. The large corporate market has seen demand and supply re-balancing as more new money deals come to market while at the same time retail inflows reversed for a few weeks. As a result, at…

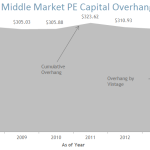

THE PULSE OF PRIVATE EQUITY

Last week we discussed the increase in valuations seen over the last 12 to 18 months in the middle-middle market, one of the drivers that we cited was the increase in competition and amount of capital chasing these deals. Today’s PitchBook chart shows that U.S. PE funds targeting middle-market deals currently have $305 billion of…

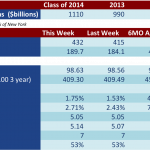

LOAN STATS AT A GLANCE

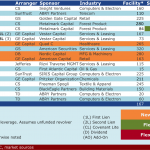

Source: S&P Capital IQ Contact: Robert Polenberg robert.polenberg@spcapitaliq.com

Lead Left Interview – Justin Kaplan

This week we speak with Justin Kaplan, Partner, Balance Point Capital Partners, a lower-middle market investment firm with offices in Westport, CT and Hartford, CT. The Lead Left: Justin, many of us know you from your days at the Alcentra mezzanine fund, but tell us about what you’re doing at Balance Point. Justin Kaplan: I joined the…

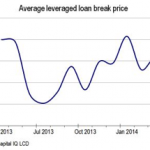

CHART OF THE WEEK

Par for the Course Softness in market technicals has driven loan prices for new-issue leveraged loan paper below par for the first time in six months, perhaps signaling better times for investors. … Login to Read More...

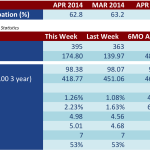

LOAN STATS AT A GLANCE

Source: S&P Capital IQ Contact: Robert Polenberg robert.polenberg@spcapitaliq.com