CP Holdings Seeks to Run Sale Process With Stalking Horse/DIP Lender Tor Asia Credit Master Fund, Prepetition Lender Under Debtor-Guaranteed Loan

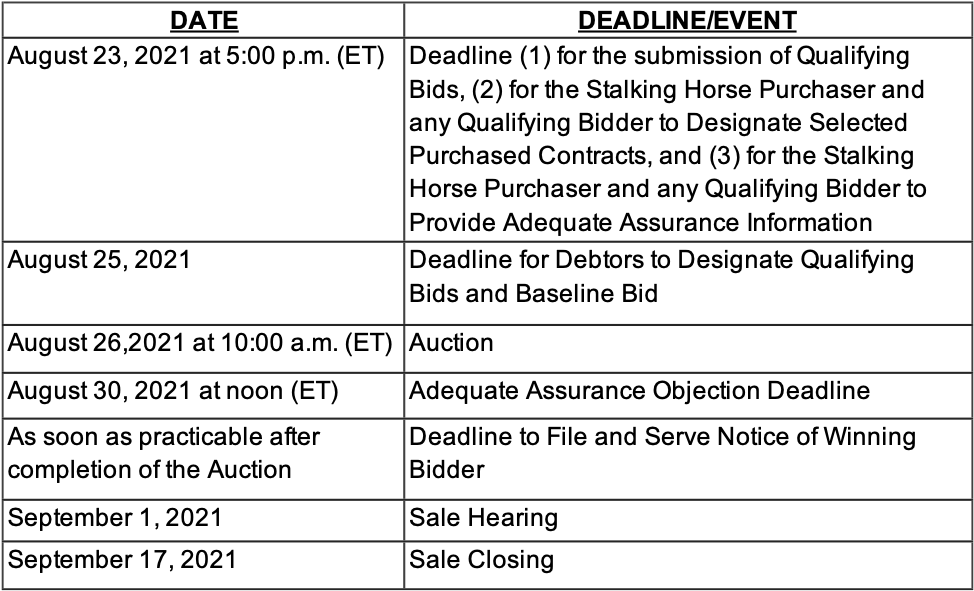

Dallas-based CP Holdings LLC and Pacrim U.S. LLC, which wholly own 47 nondebtor subsidiaries that operate 10 rural assisted living and memory care facilities in Alabama and Texas, filed for chapter 11 protection on Sunday, June 20, in the Bankruptcy Court for the District of Delaware. The debtors filed for chapter 11 under forbearance with prepetition first lien lender Tor Asia Credit Master Fund LP with respect to $66.4 million in first lien obligations for which the debtors are guarantors, after affiliate CP Global and other obligated parties made repeated covenant and payment defaults on the first lien obligations. The company seeks to sell substantially all of their assets to Tor for a credit bid of (i) $14.9 million of first lien obligations and (ii) all DIP obligations. For access to our First Day by Reorg team’s full case summary of the CP Holdings chapter 11 filing click here.

Contact: Matt Danese

mdanese@reorg.com