TheLeadLeft

The Pulse of Private Equity – 1/25/2021

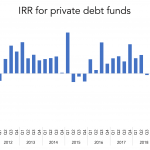

-6.2% Q1 performance for private debt Download PitchBook’s Report here. Private debt performance struggled in Q1, according to PitchBook’s just released Global Private Debt Report. Globally, private debt funds recorded a 6.2% drop in IRR in the first quarter. While not surprising, it was the worst quarterly performance since the financial crisis, when reliable performance data…

Covenant Trends – 1/25/2021

Percentage of Loans that Allow Uncapped Synergies & Cost Savings EBITDA Adjustments Contact: Steven Miller

LevFin Insights: High-Yield Bond Statistics – 1/25/2021

Source: LevFin Insights Source: LevFin Insights Source: Lipper Contact: Robert Polenberg robert.polenberg@levfininsights.com

Debtwire Middle-Market – 1/25/2021

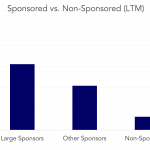

Institutional loan pricing tightens sharply in January Source: Debtwire Par Strong demand for loans has pushed pricing sharply tighter in January, with the first-lien institutional benchmark hitting its lowest level since 1Q20. So far this month, margins have averaged Libor+320 bps, down from L+ 413bps in 4Q20. Original issue discounts (OIDs) have also posted a…

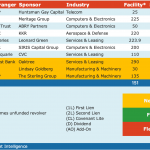

Private Debt Intelligence – 1/25/2021

Private Debt AUM Reached a New Peak The global economic slowdown in 2020 has pushed AUM across private debt to new record levels. As of June 2020, private debt AUM stands a $887bn. The market is now more than three times bigger than it was ten years ago, when managers held just $263bn in assets….

2020: A Year of Surprises (Part Three)

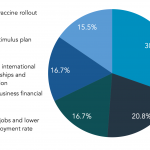

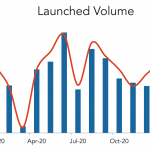

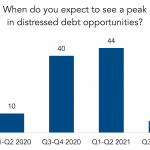

We continue our special series with the third of our “Five Biggest Private Capital Surprises of 2020:” Surprise #3: Where Are the Distressed Loans? Last April as the pandemic crisis unfolded, the CEO of a $20 billion asset manager cited $1 trillion as the volume of potential distressed credit investments. COVID has presented, he said,…

Chart of the Week: Hope Springs

Most investors expect distressed loans to peak before the second half of 2021.