Private Debt Intelligence – 2/17/2020

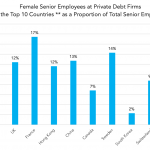

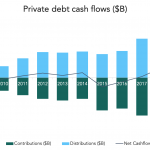

Women in Private Debt With a growing body of research indicating that more diverse teams and inclusive workplaces directly correlates with stronger business outcomes, the issue of diversity in private debt continues to move up the agenda. Preqin’s 2020 Women in Alternative Assets Report found the proportion of female employees in the alternative assets industry…