The Pulse of Private Equity – 9/22/2025

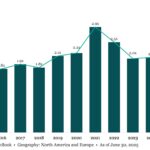

M&A EV/revenue multiple for deals between $25 million and $1 billion Download PitchBook’s Report here. Middle-market valuation multiples are pointing to an increasingly liquid M&A market with valuation expectations broadly aligned with the 2017-2019 range, setting aside the distortions of the pandemic era…. Subscribe to Read MoreAlready a member? Log in here...