PDI Picks – 4/15/2024

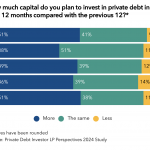

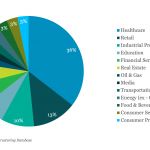

The investor view from Asia The need for income and the attractive risk/return profile of senior strategies are among the reasons why private debt is popular among LPs based in APAC. Private Debt Investor’s recent APAC Forum in Singapore featured many views and insights from leading investors in the region. As our chart shows, appetite…