TheLeadLeft

Covenant Trends – 7/20/2020

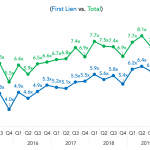

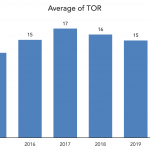

Average Unadjusted Leverage for M&A-Driven Loan Deals Contact: Steven Miller

Private Debt Intelligence – 7/20/2020

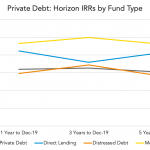

Private Debt Performance Remains Positive Horizon IRRs for the overall private debt asset class remains above 6% for one-, three- and five-year horizon to December 2019, oscillating between 6.1% and 6.5%. Direct lending funds improved over the past quarter, contrasting with the overall private debt asset class…. Subscribe to Read MoreAlready a member? Log in

The New M&A (First of a Series)

This week we kick off a new series on COVID-impacted deal flow, with a look “upriver.” How has M&A activity been affected, and what should deal makers expect for the “new normal?” We spoke to select middle market investment banks about their experiences so far in this coronavirus season. The beginning of the crisis caught…

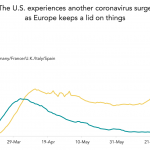

Chart of the Week: Case Study

Opening of state economies has new COVID cases in the US outpacing Europe.

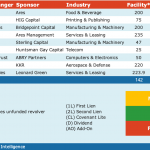

PDI Picks – 7/20/2020

The long and winding road Fund managers have found it difficult persuading investors to part with commitments during the pandemic, but demand is still strong. It’s not only economies upon which the covid-19 pandemic is having a slowing effect. As our chart above shows, it’s also the speed with which investors are making commitments to…

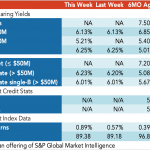

Loan Stats at a Glance – 7/20/2020

Contact: Marina Lukatskymarina.lukatsky@spglobal.com

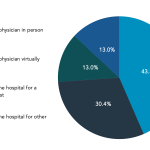

The New Healthcare: COVID and the Government

Two years ago, we issued a special report on healthcare trends. We recently revisited one of our sources, a top healthcare investor. “Everyone’s an infectious disease expert now,” he told us in an interview. “We need to change the way we look at infection. There are about 40,000 deaths annually from the seasonal flu. It […]