TheLeadLeft

PDI Picks – 6/22/2020

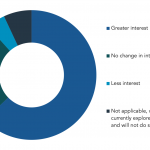

Is distressed best for LPs? Fundraising targeting troubled companies is gathering pace, with surveys suggesting investors are keen to jump on board. “We estimate that about half a trillion dollars across credit segments are trading at distressed levels,” said Karim Cherif and Jay Lee of UBS Global Wealth Management in a report published in mid-June….

Covenant Trends – 6/22/2020

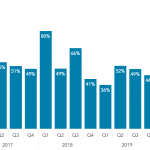

Percentage of Loans with F&C Tranche / Pro Forma EBITDA >0.9x (All Deals) Contact: Steven Miller

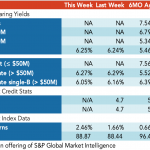

Loan Stats at a Glance – 6/22/2020

Contact: Marina Lukatskymarina.lukatsky@spglobal.com

The Pulse of Private Equity – 6/15/2020

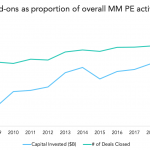

Add-ons appear healthy Download PitchBook’s Report here. At the outset of the quarantines, at least one market observer—yours truly—believed add-ons would hit the pause button after two torrid years of deal flow. The assumption: it was hard to imagine too many add-ons being done when existing portfolio companies had so many sudden issues of their own….

Leveraged Loan Insight & Analysis – 6/15/2020

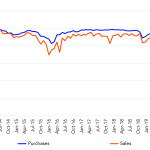

US CLO portfolios: average loan trades fell 7 to 13 points in March and April In the wake of the spread of COVID-19, as secondary loan prices plummeted, average US CLO portfolio trade prices fell between 7 and 13 points in March and April. By the end of April, sales prices were still declining, having…

Debtwire Middle-Market – 6/15/2020

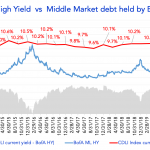

Source: Cliffwater Direct Lending Index and BofA Merrill Lynch US High Yield Effective Yield The red line in the chart is the *Cliffwater Direct Lending Index (CDLI) current yield, which is based on the investment income of the underlying assets held by public and private BDCs. BDCs invest in middle market companies, and the Index…

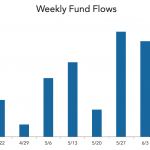

LevFin Insights: High-Yield Bond Statistics – 6/15/2020

Source: LevFin Insights Source: LevFin Insights Source: Lipper Contact: Robert Polenberg robert.polenberg@levfininsights.com

DL Deals: News & Analysis – 6/15/2020

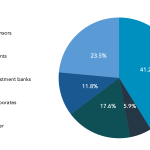

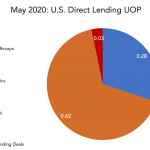

After outpacing M&A add-on activity for the past six months, LBOs fell in May, to a 28% share of direct lending loans, as tracked by DLD. Add-ons accounted for 62%, up from 37% in April. Opportunistic refinancings and dividend deals were absent altogether last month…. Subscribe to Read MoreAlready a member? Log in here...