High-Yield and Private Credit

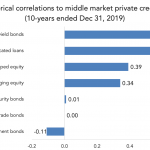

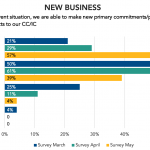

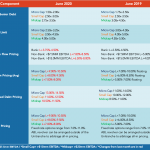

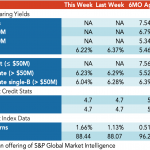

In our just-completed series on high-yield bonds, we concluded that issuer and investor activity has largely been driven by technical factors: near-zero interest rates, the Fed’s support of fallen angels, and skewed-to-worse ratings for leveraged loans. How then should investors be thinking about the illiquid market? Private credit has a different profile than tradable assets. […]