TheLeadLeft

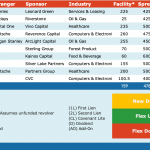

Select Deals in the Market – 6/24/2019

☞ Click for a larger image.

Leveraged Loan Insight & Analysis – 6/24/2019

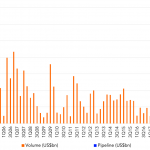

LatAm lending increases for third quarter in a row Latin America syndicated loan issuance was at US$12.2bn in 2Q19 as of June 19. While this is down 30% from 2Q18 numbers, it is up 72% from 1Q19 levels. An additional US$16.5bn were in the pipeline, suggesting an active 3Q19…. Login to Read More...

Private Debt: Search for Transparency (First of a Series)

In all the excitement surrounding our just-ended special series on covenant-easing [link] we must have missed it. But several readers pointed out we had neglected to cover the highly unusual sighting last month of a great white shark in Long Island Sound. Cabot, a nine-foot, eight-inch, 533 lb. tagged fish had been tracked for months….

Chart of the Week: Senior Housing

The recent pick-up of senior lending coincides with new private credit providers entering the market.

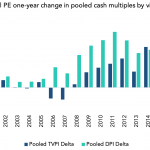

The Pulse of Private Equity – 6/24/2019

Breaking down the latest in private equity fund performance Download PitchBook’s Report here. Private equity has had banner decade by multiple metrics. As mentioned in last week’s edition of the Lead Left in this column, cash flows are still trending positively, contributing to likely another banner year for fundraising across the industry. Delving more deeply, it’s…

Covenant Trends – 6/24/2019

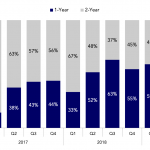

Distribution of MFN Maturity Carveout Horizons Contact: Steven Miller

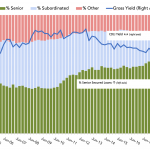

LevFin Insights: High-Yield Bond Statistics – 6/24/2019

Source: LevFin Insights Source: LevFin Insights Source: Lipper Contact: Robert Polenberg robert.polenberg@levfininsights.com

Private Debt Intelligence – 6/24/2019

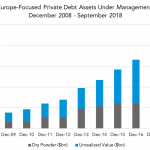

Europe Private Debt Over the past ten years, private debt fundraising has grown from $23bn in 2009 to $118bn in 2018. A big proportion of this expansion can be attributed to Europe. Eighty-seven percent of private debt investors believe Western Europe presents the best opportunities in private debt, from which 34% is attributed to the…

Debtwire Middle-Market – 6/24/2019

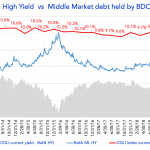

Source: Cliffwater Direct Lending Index and BofA Merrill Lynch US High Yield Effective Yield The red line in the chart is the *Cliffwater Direct Lending Index (CDLI) current yield, which is based on the investment income of the underlying assets held by public and private BDCs. BDCs invest in middle market companies, and the Index…