TheLeadLeft

The Pulse of Private Equity – 1/13/2020

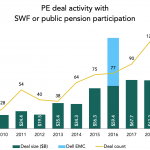

2020 prediction – SWFs and pensions will become more sophisticated Download PitchBook’s Report here. Sovereign wealth funds and public pensions financed private equity for years before they began co-investing in deals alongside their GPs. Though the trend is well publicized, the practice is still rare overall. Pension funds co-invest in about 2% of all US deals…

PDI Picks – 1/13/2020

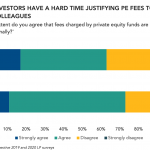

Fees are still a sticking point for private equity LPs High fees have become a focus for critics of the industry, and fund managers will need to make their case to the voting public. Almost three-quarters of LPs find private equity fund fees difficult to justify to their colleagues, according to the 2020 edition of…

DL Deals: News & Analysis – 1/13/2020

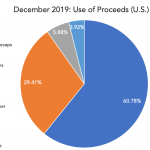

DL Deals Monthly Scorecard: December buyouts swamped volume, lenders closed out 51 transactions Buyouts swamped direct lending activity in December, accounting for 61% of volume, a big leap from the two previous months that saw more action in M&A Add-On business, according to DL Deals. For the quarter, the increase in buyouts pushed LBOs above…

Covenant Trends – 1/13/2020

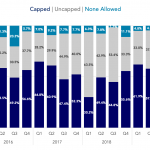

Synergies & Cost Savings EBITDA Addbacks (Capped vs. Uncapped vs. None Allowed) Contact: Steven Miller

2020 Hindsight

Remember your summer internships in high school? Neither do we. There’s a vague recollection of delivering mail for a financial advertising agency on Wall Street. (It’s also where we first encountered the term “Lead Left,” but that’s another story). Wolf Cukier’s stint at NASA’s Goddard Space Flight Center last summer could have been equally tedious….

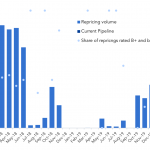

Chart of the Week: Back to Earth

2019 leveraged loan volume was off 35%; the second straight decline since the 2017 peak.

Debtwire Middle-Market – 1/13/2020

Loan repricing streak continues into 2020, spreads to single-B names Source: Debtwire Par Institutional loan repricings have continued their hot streak into 2020, with USD 17.9bn of repricings in the syndicated loan pipeline as of January 15. This represents roughly half of all institutional loans currently in the syndication phase. 2019 was a light year…

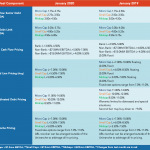

Middle Market Deal Terms at a Glance – Jan 2020

Source: SPP Capital Partners Contact: Stefan Shaffer stefan@sppcapital.com