Leveraged Loan Insight & Analysis – 7/24/2017

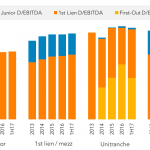

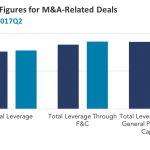

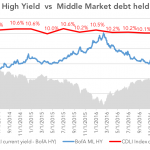

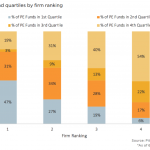

Leverage peaks in the middle market across capital structures in 1H17 With market conditions extremely heated, leverage levels have peaked across most capital structures in the middle market in 1H17. The “all senior” capital structure hit a new peak at 3.83 times in 1H17, up from 3.79 times last year and from 3.41 times back…