TheLeadLeft

How Big is the Middle Market? (Second of a Series)

To get a better handle on the total universe of middle market loans, let’s define what we mean by the middle market. Should we include, for example, both non-sponsored as well as sponsored loan volume? Thomson Reuters LPC estimates there’s been an average of $100 billion in annual non-sponsored activity since 2000. But these financings…

Lead Left Interview – Ted Goldthorpe

This week we chat with Ted Goldthorpe, head of credit for BC Partners. Ted launched the BC Partners Credit business in 2017 and oversees a team of experienced credit professionals. As a managing partner of the firm, Ted is also a member of the Investment committee of the private equity business. Previously Ted was president…

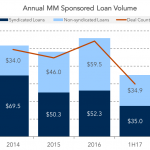

Chart of the Week: Taking Credit

Annual issuance of middle market sponsored loans has averaged just over $100 billion, though 2017 is running at a $140 billion pace.

Private Debt Intelligence – 7/24/2017

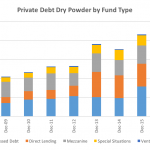

Private Debt Dry Powder Holds Steady As at the end of June 2017, private debt managers held more than $205bn in dry powder, up slightly from the $196bn recorded at the end of 2016. This relatively small increase demonstrates another way in which the private debt market is becoming increasingly distinct from the private equity…

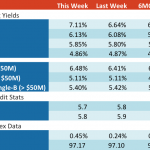

Loan Stats at a Glance – 7/24/2017

Contact: Timothy Stubbs timothy.stubbs@spglobal.com

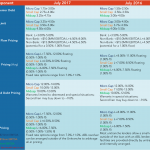

Middle Market Deal Terms at a Glance – July 2017

Source: SPP Capital Partners Contact: Stefan Shaffer stefan@sppcapital.com

Markit Recap – 7/17/2017

Senior Financials dips below 50bps Few would question the supportive role Mario Draghi has played over the last six years. Under his presidency, the ECB quickly reversed the ill-advised rate hikes in 2011 and subsequently loosened policy – the refinancing rate has been at or close to zero since 2014…. Subscribe to Read MoreAlready a

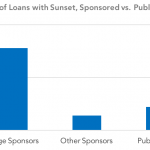

Covenant Trends – Percentage of Loans with Sunset, Sponsored vs. Public

Contact: Steven Miller smiller@covenantreview

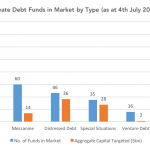

Private Debt Intelligence – 7/17/2017

Direct Lending Drives Private Debt Fundraising Market Following the record private debt fundraising seen in Q4 2016, during which 51 funds reached a final close, the number of funds in market seeking investment stood at 293 at that start of 2017. Further robust fundraising in Q1 saw this number fall slightly to 283 at the…