Leveraged Loan Insight & Analysis – 7/10/2017

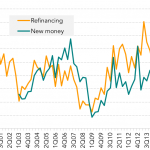

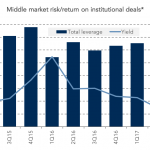

Middle market loan volume disappoints in 2Q17 Despite all the capital flowing into the middle market, loan supply continued to disappoint in 2Q17. Total middle market loan issuance reached US$39.8bn in 2Q17, up a slight 2% and 7% from 1Q17 and 2Q16 levels…. Subscribe to Read MoreAlready a member? Log in here...