Leveraged Loan Insight & Analysis – 6/5/2017

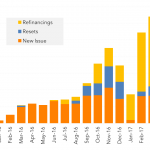

U.S. new issue CLO volume outpaces refinancings for first time in 2017 May marked the first month this year where U.S. new issue CLO volume outpaced refinancing volume. CLO new issue amounted to $9.8 billion in May, slightly down from the $10.2 billion posted in April, taking 2017 issuance to $37.5 billion…. Subscribe to Read