Private Debt Intelligence – 3/20/2017

Private Debt Fund Performance by Strategy

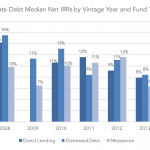

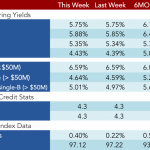

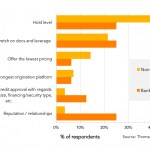

The private debt asset class has continued to satisfy institutional investors with 93% of those surveyed by Preqin at the end of 2016 stating that the performance of their private debt investments had either met or exceeded expectation. However, performance as measured by the median net IRR of funds varies notably across the three central private debt strategies: direct lending, mezzanine and distressed debt...