TheLeadLeft

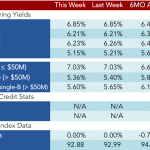

Loan Stats at a Glance – 7/4/2016

Contact: Timothy Stubbs timothy.stubbs@spglobal.com

Markit Recap – 6/27/2016

Those of us who stayed up to watch the Brexit television coverage knew that in a few hours’ time the June 24 trading session would go down in history. The mainstream media were inevitably obsessing about the post-Brexit collapse in sterling, but the credit markets were focused on the Markit iTraxx indices. Big moves were…

What Brexit Means for Loans

“Thank God for the Electoral College.” Thus the co-head of a major credit trading desk put a brave face on the US political outlook after last week’s stunning Brexit vote. And while the wisdom of our Founding Fathers may shield us from a similar upheaval in the direct popular vote for President, there’s no guarantee…

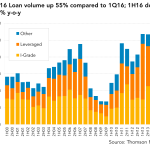

Leveraged Loan Insight & Analysis – 6/27/2016

Supported by solid technicals and a steady – if uninspired – pipeline of deals, the US loan market got a substantial boost in 2Q16 to push over US$550 billion in loan volume through the market and logging nearly US$905 billion of total issuance during the first six months of the year. Coming off a slow…

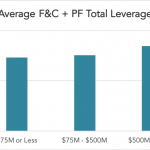

Covenant Trends: Average F&C + PF Total Leverage

Contact: Steven Miller smiller@covenantreview.com

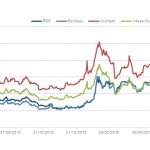

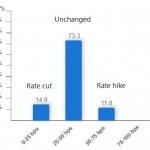

Chart of the Week: EU-Turn

Thanks to Brexit, market watchers now think the probability of a Fed rate cut this year outweighs that of a rate hike. Sources: The Daily Shot, CME Group

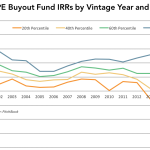

The Pulse of Private Equity – 6/27/2016

Recent Wave of Exits Differentiated U.S. PE Fund Managers The boom in private equity-backed selling observed over the past few years, cresting in 2015, yielded rich returns for certain U.S. buyout funds. More than that, it proved a differentiating area for the top tier of U.S. fund managers. As illustrated by the chart above, certain…

Lead Left Interview – Jessica Reiss and Justin Forlenza (Part 2)

This week we continue our conversation with Jessica Reiss and Justin Forlenza, attorneys with Covenant Review. Begun in 2006, Covenant Review is the world’s first boutique research firm focused on bond and loan covenants. Second of two parts – View part one The Lead Left: MFN is triggered if the company raises debt priced 50 bps from…