The Pulse of Private Equity – 3/27/2017

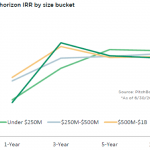

On a long enough horizon, returns for PE funds of all sizes converge

By and large, the macroeconomic environment remains the most significant factor to bear in mind when assessing long-term private equity fund performance. Given the impact of the financial crisis, it makes sense that no matter the size of the fund in question, at the longest time horizon—10 years—internal rates of return (IRRs) have by and large converged. Following the typical J-curve of fund performance, at that point in the conventional fund lifecycle most assets that end up contributing to the majority of a fund’s return have already been sold...