Why Sponsors Matter (Second of a Series)

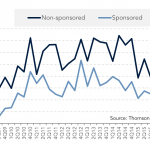

Last week we kicked off our special series examining the differences between lending to middle market companies and those backed by private equity sponsors [link]. We discussed how these companies often are founded by visionaries with great creativity, but lack the management skills to execute the business plan to its full potential. Let’s turn to…