Leveraged Loan Insight & Analysis – 4/4/2016

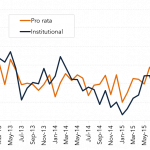

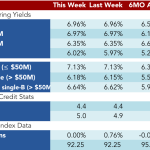

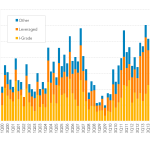

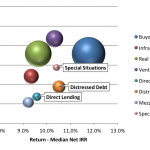

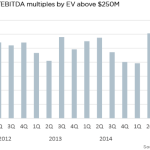

U.S. leveraged lending, at US$112bn in 1Q16, was down 29% from 4Q15 Instability in oil prices and credit concerns in energy and metals and mining, coupled with worries that slowing global growth could impact the U.S., amplified what was already shaky sentiment heading into this year. Although seeing opportunities, some distressed funds waited to pull…