Markit Recap – 3/14/2016

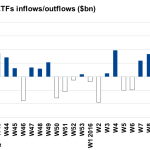

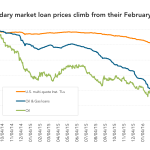

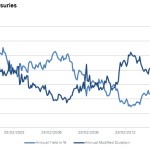

Investors embrace HY ETFs as sentiment turns High yield credit has enjoyed a sustained rally over the past five weeks and investors have taken advantage through ETFs. High yield bond ETFs have seen five consecutive weeks of positive inflows Markit iTraxx Europe Crossover index has seen its spread fall from 486bps to 332bps Oil &…