TheLeadLeft

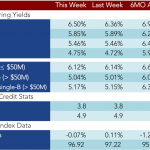

Loan Stats at a Glance – 6/22/2015

Contact: Cuong Huynh cuong.huynh@spcapitaliq.com

Markit Recap – 6/15/2015

There are many words synonymous with the European sovereign debt crisis, the portmanteau ‘Grexit’ being the most in vogue. But a word that was thought to have been banished by the ECB – contagion – has returned to the discourse this week. Spreads in Italy, Spain and Portugal – the peripheral countries most exposed to…

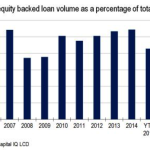

Payback Time – Readers’ Say

Our mailbag was overflowing in response to last week’s column on the topic of repayment trends in leveraged loans. Readers mostly bemoaned the lack of discipline by lenders in compelling borrowers to reduce debt in the form of real amortization. We considered how quaint the notion has become of borrowers actually repaying debt over the…

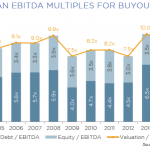

Chart of the Week – Sponsors Back Down

A combination of corporates flush with cash and the pressure of high purchase price multiples has created tougher conditions for private equity buyers.

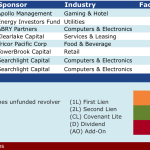

The Pulse of Private Equity – 6/15/2015

Valuations met with a shrug High valuations have become a headache in the PE industry, not only for the firms themselves but also their own LP investors. Overpaying today leads to under-reaping tomorrow. Even so, deal activity… Subscribe to Read MoreAlready a member? Log in here...

Lead Left Interview – Robert Gefaell

This week we chat with Robert Gefaell, co-founder and partner, Plexus Capital. Plexus focuses on subordinated debt investments in middle market companies, with a total of $550 million under management across three funds. The Lead Left: Robert, you and your partners got started together at the old Centura Bank, correct? Robert Gefaell: That’s right, Randy….

Leveraged Loan Insight & Analysis – 6/15/2015

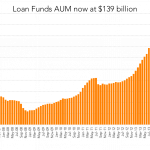

Loan mutual fund & ETF assets under management edged higher to just over $139 billion in May as these funds registered a second consecutive month of inflows as expectations around higher interest rates once again came to the fore. Despite the combined inflows of $646 million in April and May,… Subscribe to Read MoreAlready a