TheLeadLeft

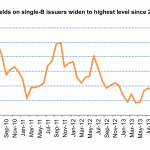

Chart of the Week – Relative Value

While market values for BDCs have recovered after October’s slump, they remain at a significant discount to both high-yield and leverage loan plays…. Subscribe to Read MoreAlready a member? Log in here...

Why BDCs Matter (Part Three)

One of the many benefits of business development companies is their ability to easily hold a wide range of investments. From senior term loans, to unitranche loans, second-lien term loans, mezzanine debt, and even preferred stock, BDCs are incredibly versatile asset management vehicles. Historically, BDCs allocated more capital to higher-yielding, thus more risky, assets; particularly…

Lead Left Interview – Bill Siegel

This week we speak with Bill Siegel, interim CEO, Second Market. His firm provides transaction process services for private companies and funds. The Lead Left: Bill, for those of our readers who aren’t familiar with you and your firm, tell us the story. Bill Siegel:Randy. I spent the first half of my career on the…

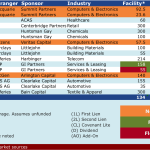

Leveraged Loan Insight & Analysis – 10/27/2014

While new launches have resumed, the institutional loan market took a hit in mid-October as global volatility spiked and investors took a step back. In tune with the high-yield bond market, the institutional loan market slowed down significantly in mid-October…. Subscribe to Read MoreAlready a member? Log in here...

Markit Recap – 10/27/2014

Earnings season is well underway and the Federal Reserve is set to end its bond purchase programme, but in Europe all eyes were on the results of the ECB’s asset quality review and stress tests. A total of 25 banks out of 130 failed the tests, though only 13 banks have capital shortfalls once prudential…

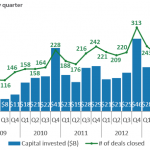

The Pulse of Private Equity – 10/27/2014

B2B is Booming The U.S. B2B industry has seen some of the strongest and most consistent activity from PE investors over the past three quarters. About $153.6 billion has been invested through Q3 2014, including another $44.6 billion in the third quarter. 2014 has already seen over $40 billion… Subscribe to Read MoreAlready a member?

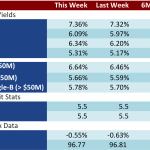

Loan Stats at a Glance – 10/27/2014

Source: S&P Capital IQ Contact: Cuong Huynh cuong.huynh@spcapitaliq.com