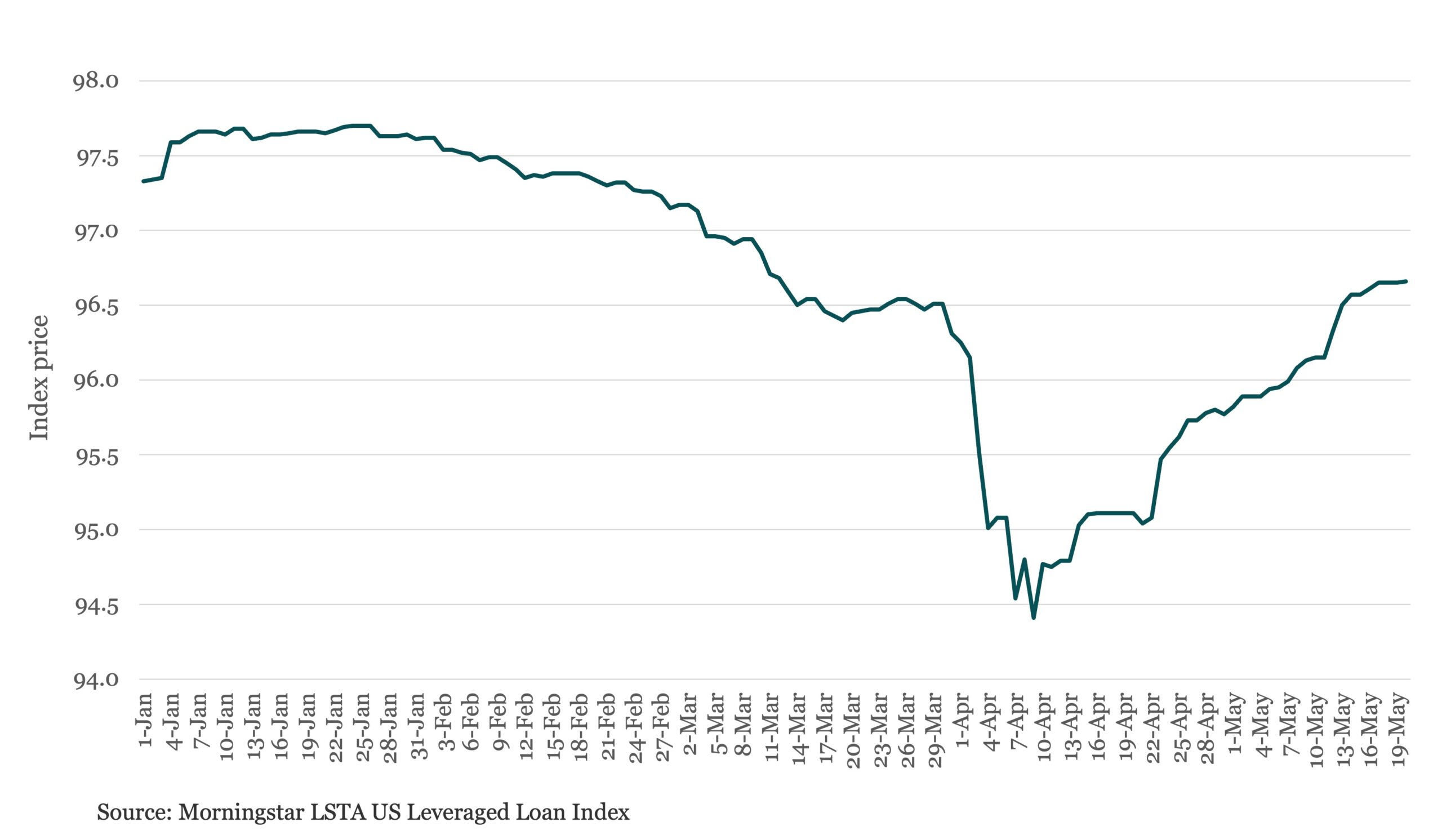

Leveraged loans claw back tariff-driven losses in secondary market

It has been a wild ride in the secondary market this year to date, driven by bouts of volatility due to uncertainty over US economic policy. Secondary market bids on US leveraged loans started the year at an average of 97.33 before sliding 329 bps from their January high to an average bid of 94.41 on April 9th, the lowest level seen since July 2023, according to the Morningstar LSTA US Leveraged Loan Index.