Debtwire Middle-Market – 11/29/2021

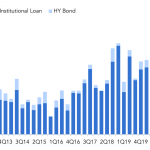

M&A transactions increasingly funded with add-on debt Source: Dealogic, Debtwire Par Issuers have been tapping the institutional loan market for add-on debt at a rapid pace, blowing past the previous five years in add-on volume with the month of December still to come. Record levels of add-on loan issuacne in September (USD 13.5bn) followed by…