Debtwire Middle-Market – 3/3/2025

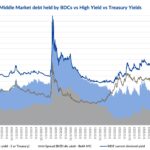

Source: VanEck BDC Income ETF, BofA Merrill Lynch US High Yield Effective Yield The blue line in the chart is the current dividend yield of the *VanEck BDC Income ETF (currently at 10.4% as of 28 February) that tracks the overall performance of publicly traded business development companies (BDCs, are lenders to privately held middle-market businesses…