The Pulse of Private Equity – 5/12/2025

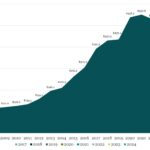

Global private debt dry powder ($B) Download PitchBook’s Report here. Halfway through 2024, private debt dry powder sat at $566.8 billion—a new high—and is on track for its second consecutive year of growth…. Subscribe to Read MoreAlready a member? Log in here...