Private Debt Intelligence – 7/27/2020

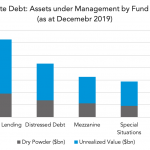

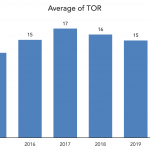

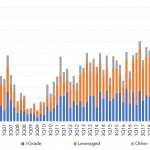

The Private Debt Market Continues to Grow The private debt industry has seen the growth in its AUM accelerate in recent years, and by December 2019 (our latest data available) funds held a total of $854bn in assets under management (AUM). The market is now more than three times bigger than it was ten years…