The Pulse of Private Equity – 7/6/2020

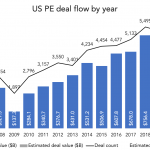

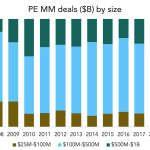

Q2 was as bad as expected PitchBook’s latest US PE Breakdown is out this Friday, and newsletter subscribers will have access to it that morning. The first full quarter of COVID-impacted data is in and it isn’t pretty. Overall US PE deal flow was down 54% from the first quarter, from 1,147 transactions to only…