PDI Picks – 4/13/2020

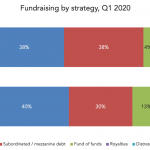

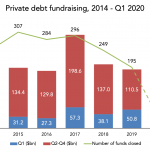

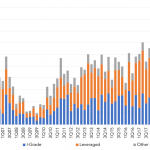

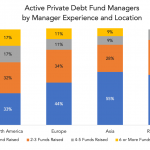

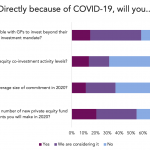

The hidden attraction of distress They may not be raking in fresh capital right now, but distressed debt managers have plenty of firepower to take advantage of current conditions. In last week’s Lead Left column, we noted that the proportion of fundraising by strategy in the first three months of this year was more or…