Private Debt Intelligence – 7/23/2018

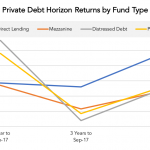

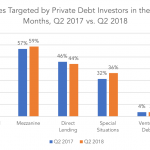

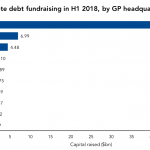

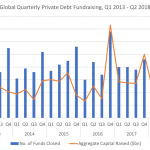

Distressed Debt Sees Strong Performance Distressed debt has seen strong success, particularly in Q2 2018: the strategy led private debt fundraising during the quarter and the majority (60%) of investors tracked by Preqin are planning to seek out distressed debt vehicles over the next 12 months. The fund type has also seen favourable returns, even…