The Pulse of Private Equity – 6/18/2018

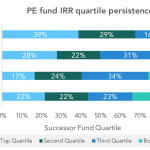

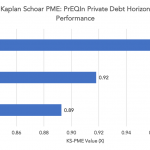

Is PE performance persistent? Download PitchBook’s Report click here. “Past performance does not guarantee future results.” Finance professionals have probably read that boilerplate disclosure so many times they may not even notice it anymore. And while that phrase has arguably reached truism status, there is a residual belief that past performance is relevant to future…