The Pulse of Private Equity – 9/11/2017

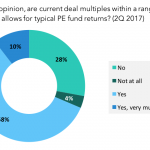

Are PE multiples reasonable? Investors think so View PitchBook’s Global PE Deal Multiples Report Here There’s an old joke in political science circles that applies, in a way, to today’s PE market. Do you approve of the job congress is doing? Not at all says the vast majority, vote them all out. How about your congressman,…